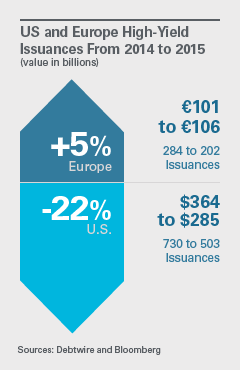

The continuation of a strong M&A market in both the U.S. and Europe, energy companies returning to the U.S. market and quantitative easing in Europe resulted in a strong first half of 2015 for U.S. and European high-yield markets. However, the markets experienced a significant slowdown in the second half of the year due to global events, weakness in commodity sectors and liquidity concerns, raising uncertainty for 2016. The U.S. high-yield market ended the year 22 percent lower by dollar value than in 2014, with $285 billion (503 issuances) compared to $364 billion (730 issuances) in 2014. The European high-yield market edged higher by value in 2015, with €106 billion (202 issuances) over the previous record of €101 billion (284 issuances) set in 2014, although there was a 29 percent decrease in the number of issuances.1

In 2016, repeat issuers and companies with strong fundamentals will continue to have the best access to the market. New issuers and more highly leveraged companies may find traditional high-yield issuances to be more challenging and as a result may seek alternative financing solutions and more creative structures, as has been seen in the energy sector.

Common Trends

The U.S. and European high-yield markets shared some key trends in 2015:

Large M&A Financings. M&A financings accounted for approximately 28 percent and 32 percent of U.S. and European high-yield market deal volume in 2015, respectively. Of note were several large issuances, including Valeant Pharmaceuticals ($10.1 billion, acquisition of Salix Pharmaceuticals), Frontier Communications ($6.6 billion, acquisition of Verizon’s wireline operations), GTECH S.p.A. ($5 billion, acquisition of International Game Technology) and Altice N.V. ($4.8 billion, acquisition of Cablevision Systems Corporation). (See “Insights Conversations: M&A.”)

Volatility. Both markets slowed dramatically in the second half of the year due to continued commodities weakness, speculation about a market correction, liquidity concerns, anticipation of Federal Reserve and Bank of England interest rate increases, and global events. (The Federal Reserve announced on December 16, 2015, that it was raising short-term interest rates by 25 basis points, the first interest rate increase since 2006.) The year ended with the first negative annual return to investors since 2008 and a prominent high-yield mutual fund freezing withdrawals.

U.S. Issuers in Europe. A number of U.S. companies looked to the European market in 2015, particularly in the first half of the year; 22 issuances (16 percent of issuances by deal volume in Europe) in that period came from across the Atlantic, due in part to U.S. companies taking advantage of European interest rates and improved trading liquidity in Europe.

US High-Yield: Key Trends

Distress in Energy Sector Impacts Market. The energy sector accounted for a significant number of high-yield issuances. Many of these, particularly for exploration and production (E&P) companies, were not traditional marketed deals. Instead, they were direct placements by issuers (without the use of an underwriter) or debt exchange offers with investors to reduce leverage or interest expense or to extend upcoming maturities. (See “Oil and Gas Companies Utilize Restructuring Strategies to Navigate Industry in Flux.”) In addition, bankruptcy filings, missed interest payments, downgraded credits and restructurings by distressed issuers resulted in an increased default rate for the sector and for high-yield bonds overall. In November 2015, the percentage of high-yield bonds in the U.S. that was considered distressed (where the spread between its yield and the yield of U.S. Treasuries surpasses 10 percentage points) reached its highest level since September 2009, and default rates rose to around 3 percent for the preceding 12 months. In Europe, by contrast, default rates remained steady at around 2 percent overall, due in part to oil and gas companies comprising a smaller percentage of high-yield bond issuers in Europe.

Increase in Private-for-Life Bonds. In reaction to recent case law under the Trust Indenture Act (TIA) and an increase in activist bondholders, issuances of private-for-life bonds increased in 2015. In such bond offerings, the issuer (even if already a public company) has no obligation to register the bonds with the Securities and Exchange Commission (SEC), and accordingly the indenture governing the bonds is not subject to the TIA. Based on deals reviewed by Xtract Research, an estimated 53 percent of new issuances in 2015 were private-for-life bond offerings, up from an estimated 39 percent in 2014.

Because reporting covenants for such bonds often are significantly less burdensome than SEC reporting requirements, issuers of private-for-life bonds historically could avoid the expense of the SEC registration and/or reporting process. In addition, following amendments to Rule 144 which shortened the period that investors are required to hold restricted securities before unrestricted resales can be made, such registration was no longer as important for transferability of the bonds. Recent decisions by the U.S. District Court for the Southern District of New York may add another reason for issuers to turn to private-for-life bonds. In those cases, the court held that certain indenture amendments required bondholders’ unanimous consent because such amendments “impaired” nonconsenting bondholders’ right to receive payment in violation of the TIA (even though the amendments did not directly change any indenture term explicitly governing the right to receive payment, and even though the indentures expressly permitted the action taken). Depending on the circumstances, these cases, if upheld, may have the effect of limiting the ability of some issuers and majority debtholders to conduct nonconsensual out-of-court restructurings/reorganizations involving debt securities subject to the TIA (or debt securities subject to similar provisions). Private-for-life bonds can give issuers the ability to preserve flexibility for future changes to their debt capital structure, as they can decide not to include TIA-mandated or similar provisions.

European High-Yield: Key Trends

Repeat Issuers Dominate Market in 2015. The market in 2014 was marked by a large number of first-time issuers (88 total with 67 in the first half of 2014 alone). In 2015, just 23 first-time issuers came to market, including 11 in the first half of 2015, due in part to increased volatility in the high-yield market, investor preference for stronger credit and competition from the leverage loan market.

Covenant Flexibility. In 2015, covenant trends continued to favor issuers, with an increase in the prevalence of soft-cap baskets (incurrence thresholds determined by a percentage of assets or EBITDA — earnings before interest, taxes, depreciation and amortization — rather than a fixed monetary amount) and other exceptions to restrictive covenants. In particular, exceptions typically only found in the U.S. high-yield market appeared in Europe, such as the ability to redeem the last 10 percent of notes outstanding if the rest of the notes have been tendered in a change-of-control offer. Covenant-lite issuances also saw an increase, growing from 8 percent of issuances in 2014 to 20 percent of issuances in 2015. A covenant package typically is considered to be “covenant-lite” if it lacks either a debt incurrence covenant or a restricted payment covenant, or both (covenant-lite deals often also lack other traditional high-yield covenants and have investment-grade style redemption provisions). One key exception to this trend of “looser covenants” was issuances containing a portable change-of-control provision (which permits the issuer to not make an offer to repurchase the bonds at 101 percent of par upon a change of control, provided a leverage test is met), which fell to 12 percent, compared to 33 percent of issuances in 2014. The trend toward fewer instances of portability brings Europe closer to the U.S. standard that infrequently features portability.

Voice of the Investor. Investors in Europe were vocal in 2015 on increasingly issuer-friendly covenants and the shortening of call periods, and they sought improved access to issuers’ periodic reports. U.S. issuers may hear similar investor concerns, as issuer-friendly covenants are prevalent in the U.S. market — Moody’s reported that its covenant quality index (based on protection for investors) for U.S. issuances reached a record low in November 2015.

Outlook

The market for 2016 may continue to benefit from M&A activity and companies needing to refinance near-term bonds, but expectations remain tempered due to continued volatility and concerns about increased risk as the market looks to rebound from a slow fourth quarter.

_______________________1 Sources for the data in this article are: Debtwire, highyieldbond.com, S&P Capital IQ LCD, Thomson One, Bloomberg, Xtract Research and Mergermarket.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.