In this issue, we cover regulatory developments impacting the investment management sector, including updates on closed-end fund activism; new SEC proposals; and the impact of Russia sanctions on disclosure obligations and cybersecurity preparedness, disaster recovery and operational resiliency.

- Closed-End Fund Activism Update

- SEC Proposals Update

- Cybersecurity Risk Management, Strategy, Governance and Incident Disclosure

- Enhancement and Standardization of Climate-Related Disclosures for Investors

- Modernization of Beneficial Ownership Reporting

- Private Fund Advisers; Documentation of Compliance Reviews

- Amendments to Form PF

- Money Market Fund Reforms Modernization

- Shortening the Securities Transaction Settlement Cycle

- Short Position and Short Activity Reporting by Institutional Managers

- Share Repurchase Disclosure Modernization

- Rule 10b5-1 and Insider Trading

- 2022 Compliance Dates for Recently Adopted Final Rules

- Good Faith Determinations of Fair Value Under the 1940 Act

- Use of Derivatives by Registered Investment Companies and Business Development Companies

- Investment Adviser Advertisements; Compensation for Solicitations

- Regulation, Disclosure and Exams

Closed-End Fund Activism Update

Activist closed-end fund investors continue to take large positions in closed-end funds and engage in disruptive activity that is harmful to long-term retail closed-end fund shareholders. In addition to the usual motive of seeking close-to-net-asset-value (or even above-NAV) “liquidity events,” a trend we have been seeing is activists seeking full takeovers of funds with little regard for providing shareholders with information on their plans for the fund. This is especially challenging when funds with less common strategies are targeted, given the potential loss of a desired investment option for retail long-term shareholders if the activist, after the takeover, modifies the fund’s strategy to something significantly more risky designed to complement their overall activism and arbitrage strategies.

Activists have also been active in litigation challenging closed-end fund actions designed to protect long-term shareholders from coercive tactics. In particular, since the Securities and Exchange Commission (SEC) staff’s 2020 statement repealing the Boulder Letter,1 many closed-end funds have adopted control share provisions, and activists are presently litigating the Investment Company Act of 1940 (the 1940 Act) issues relating to such provisions. In particular, this litigation produced a ruling from the U.S. District Court for the Southern District of New York, in Saba Capital CEF Opportunities 1, Ltd. v. Nuveen Floating Rate Income Fund,2 that a closed-end fund organized as a Massachusetts business trust — and adopting bylaw provisions having the effect of opting in to a control share statute — violates Section 18(i) of the 1940 Act, which provides that every share of stock “shall be a voting stock and have equal voting rights with every other outstanding voting stock.” The closed-end fund at issue has appealed the district court’s decision to the U.S. Court of Appeals for the Second Circuit. The final outcome of this litigation, and the final position of certain federal courts on closed-end funds’ use of control share provisions, is therefore yet to be determined.

The Nuveen ruling appears to suggest that a closed-end fund may have a better legal basis under the 1940 Act to use control share provisions when it uses an express statutory scheme applicable to it under state law3 which, presently, is only available to Maryland corporations opting in to the Maryland Control Share Acquisition Act (MCSAA).4 We believe that the fact pattern of a closed-end fund organized as a Maryland corporation opting in to the MCSAA is the clearest in light of the Nuveen ruling given (1) that Section 18(i)’s requirements only apply unless “otherwise required by law,”5 (2) the direct applicability of the SEC staff’s 2020 statement on the topic and (3) the fact that Section 18(i) and Maryland law can be read to not conflict on this point, thus creating a constitutional argument that federal law should not supplant state law in this instance.

Therefore, until the outcome of this litigation is finally determined, boards of closed-end funds should carefully consider their options in opting in to or adopting control share provisions, or enforcing control share provisions that have been implemented.

SEC Proposals UpdateCybersecurity Risk Management, Strategy, Governance and Incident Disclosure

On March 9, 2022, the SEC proposed a set of comprehensive cybersecurity risk management rules and related disclosure amendments under the Investment Advisers Act of 1940 (the Advisers Act) and the 1940 Act. While a bulk of the proposals are simply a formal adoption of existing standards borne out of SEC interpretive guidance, risk alerts and related enforcement proceedings — particularly with respect to the requirement to formally adopt written policies and procedures reasonably designed to address cybersecurity risks — the proposal imposes express new cyber-related disclosure, reporting and certain other burdens on investment advisers, investment companies, business development companies (collectively, “Registrants”) and each of their respective boards that fall squarely outside the scope of current industry practices.

Cybersecurity Risk Management Program

As proposed, the risk management framework would require all Registrants, regardless of their size, to conduct a comprehensive risk assessment related to “financial, operational, legal, reputational, and other adverse consequences that could stem from cybersecurity incidents, threats, and vulnerabilities.” Consistent with a Registrant’s existing compliance obligations under Rule 206(4)-7 of the Advisers Act and/or Rule 38a-1 under the 1940 Act, such an assessment would need to be conducted “periodically” and form the basis for the written compliance policies and procedures required to be adopted under the proposal, including annual reviews and written reports related to testing and cybersecurity risk identification.

At a minimum, the proposal would require Registrants to focus their assessments and written policies and procedures around categorization and prioritization of the following: risks, information and information systems security, services provider oversight, access controls, acceptable use policies and procedures, dual-factor authentication across critical information systems access points, remote access security, client access and reporting systems security, information storage, data and information transmission, protection and intrusion detection, as well as adequate monitoring, threat and vulnerability management capabilities, and incident response and recovery.

Similar to other rules promulgated under the Advisers Act and 1940 Act, the proposal does not include overly prescriptive requirements related to the required scope or frequency of adequate risks assessments and related written policies and procedures. The proposal would encourage Registrants to adopt and implement the required elements of the proposal based on the size, scope and complexity of their unique operations in relation to the proposal’s stated objectives.

Board Oversight

The proposal states that boards would be expected to engage in an ongoing review of reported information sufficient enough to enable a board to understand the effectiveness of a Registrant’s written policies and procedures in relation to its identified cybersecurity risks, to document such understanding and to conclude whether the Registrant has sufficient resources to mitigate such risks.

SEC Reporting and Public Disclosure Requirements

In addition to the requirement to adopt and implement the proposal’s risk management framework, advisers would be required to report significant cybersecurity incidents directly to the SEC on new Form ADV-C promptly but in no event later than 48 hours following the adviser’s conclusion that a significant event occurred at the adviser or fund level. The proposal indicates the new Form ADV-C will not be publicly available and is for SEC monitoring and tracking purposes only. That said, Registrants would be required to make related public disclosures that identify their specific cybersecurity risks and the details of any significant cybersecurity incidents that occurred within the previous two fiscal years.

For investment advisers, disclosures would be made on an amended Form ADV Part 2A and for registered funds, on amended registration statements, such as Form N-1A and Form N-2. In all cases, Registrants would have to address with sufficient detail the cybersecurity risks that may materially impact their ability to meet their contractual obligations or provide their services, as well as detail their methods for assessing and prioritizing cyber-related risks. Finally, Registrants would be required to publicly disclose on Form ADV Part 2 or registration materials, as applicable, any information regarding incidents and breaches that occurred within the previous two fiscal years that resulted in a disruption in the adviser’s critical operations or any unauthorized access of the Registrant’s (including its affiliates) information.

Key Takeaways

As proposed, the rules impose significant additional burdens on the Registrants to allocate time, personnel and capital resources to developing in-house cybersecurity expertise, systems and service provider oversight capabilities.

Enhancement and Standardization of Climate-Related Disclosures for Investors

On March 21, 2022, the SEC voted 3-1 to propose long-anticipated rules mandating climate-related disclosures in companies’ annual reports and registration statements. The proposed rules would add extensive and prescriptive disclosure items requiring companies, including foreign private issuers, to disclose climate-related risks and greenhouse gas (GHG) emissions. In addition, the proposed rules would require the inclusion of certain climate-related financial metrics in a note to companies’ audited financial statements.

Key Takeaways

The proposed rules would require companies to provide climate-related information in a separately captioned section of annual reports and registration statements based on a detailed list of specific disclosure items. They include, among other items, climate-related risk oversight and governance, climate-related risks and their impacts on business strategy and outlook, Scopes 1 and 2 GHG emissions and, for certain companies, Scope 3 GHG emissions (i.e., indirect emissions from upstream and downstream activities in a company’s value chain). The proposal also would require a new note to companies’ audited financial statements addressing climate-related impacts on financial statement line items. In addition, large accelerated and accelerated filers would be required to obtain independent third-party assurance of their GHG emissions.

The proposed rules contemplate phase-in periods based on SEC filer status, with extended phase-in periods for Scope 3 disclosures and third-party attestation requirements. For example, if the final rules are effective by December 2022, large accelerated filers would begin providing the new disclosures in 2024 with respect to fiscal year 2023.

As proposed, the rule applies to business development companies but not to registered investment companies (such as registered closed-end funds). That said, the SEC has expressly requested comment as to the application of the proposed rule to business development companies, and the investment company industry generally is following this proposal closely given the sustained focus on environmental, social and governance (ESG) investment criteria.

For more, see our March 24, 2022, client alert “SEC Proposes New Rules for Climate-Related Disclosures.” For additional considerations, see our June 29, 2021, client alert “Enhancing Disclosure Controls and Procedures Relating to Voluntary Environmental and Social Disclosures.”

Modernization of Beneficial Ownership Reporting

On February 10, 2022, the SEC voted 3-1 to approve proposed changes to public company beneficial ownership reporting requirements. The SEC has long considered such changes to the rules it adopted pursuant to Securities Exchange Act of 1934 Sections 13(d) and 13(g), which require that beneficial owners of more than 5% of a company report such ownership on either a Schedule 13D or a Schedule 13G. If adopted, these new rules will make significant changes to beneficial ownership disclosure obligations in the SEC’s effort to update reporting requirements to provide more timely and complete information for the modern market. Closed-end funds should follow this proposal closely, as it has the potential to impact monitoring of activist positions in closed-end funds and potential strategies to combat coercive tactics by certain market participants seeking short-term gains at the expense of long-term retail closed-end fund shareholders.

Accelerated Schedule 13D and 13G Filing Deadlines

Under the current reporting regime, beneficial owners must file a Schedule 13D within 10 days after acquiring more than 5% of a class of registered voting equity securities and must “promptly” thereafter file an amendment to report any material changes. The SEC’s proposed rules shorten the initial deadline for Schedule 13D filings to five days and require amendments to be filed within one business day of any material change in previously reported beneficial ownership.

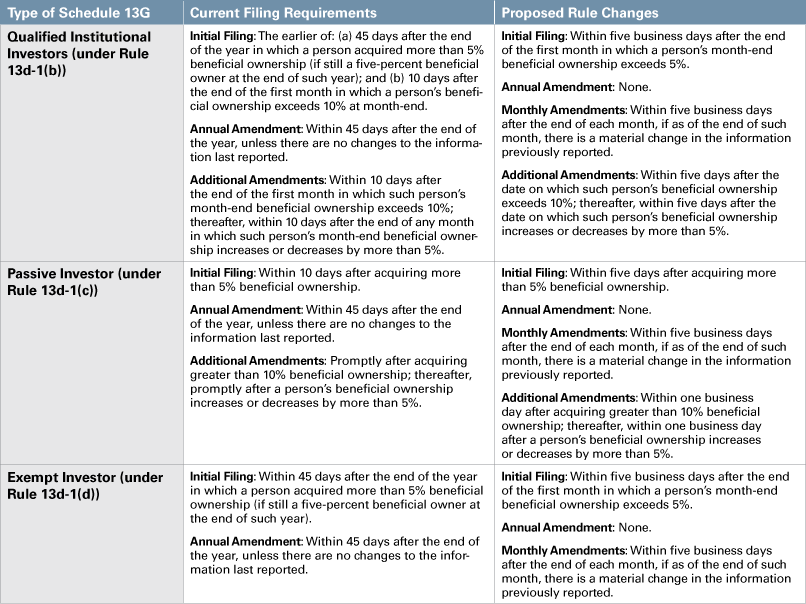

The proposed rules also shorten the deadlines for initial and amended filings by beneficial owners who are eligible to file the more abbreviated Schedule 13G. The current deadlines for Schedule 13G depend on whether a person files as a qualified institutional investor (pursuant to Rule 13d-1(b)), passive investor (pursuant to Rule 13d-1(c)) or exempt investor (pursuant to Rule 13d-1(d)). The table set forth below summarizes the current Schedule 13G filing deadlines and the SEC’s proposed changes.

Expansion of ‘Deemed’ Beneficial Ownership and Disclosure of Derivative Securities

The proposed changes expand the current regulatory framework to include that holders of cash-settled derivative securities, other than security-based swaps, would be “deemed” beneficial owners of the reference equity securities if the derivatives are held with the purpose or effect of changing or influencing the control of the issuer of the reference securities, or in connection with or as a participant in any transaction having such purpose or effect.6 This update may cause certain holders of such derivatives to become 5% beneficial owners subject to Schedule 13D/G reporting and/or 10% beneficial owners subject to Section 16 (where such holders previously may not have been defined that way).

In addition, the proposed changes would revise Item 6 of Schedule 13D to clarify that a person is required to disclose, among other things, “any class of [an] issuer’s securities used as a reference security, in connection with … call options, put options, security-based swaps or any other derivative securities.” Beneficial owners would be required to disclose interests in all derivative securities (including cash-settled derivative securities) that use the issuer’s equity security as a reference security.

Updated Requirements for Group Formation

Sections 13(d)(3) and 13(g)(3) of the Exchange Act and Rule 13d-5 under the Exchange Act provide that two or more persons or entities beneficially owning shares of registered securities may be deemed to have formed a “group,” which acts as a “person” for purposes of beneficial ownership reporting. However, as the SEC has explained, “the determination of whether coordinated efforts” among such “persons constitutes a group subject to regulation as a single ‘person’” has largely been a “question of fact.”

The SEC is proposing to amend Rule 13d-5 to align it more with the text of Sections 13(d)(3) and 13(g)(3). These changes are intended to remove the implication that an express agreement by two parties to act together is a requirement for formation of a group.

The SEC’s proposed changes also clarify the circumstances under which two or more persons have formed a “group” to include, among other things, “tipper-tippee” relationships in which a person shares nonpublic information about an upcoming Schedule 13D filing with another person who subsequently purchases the issuer’s securities based on such information. The proposed amendments also expressly attribute “acquisitions made by a group member after the date of group formation … to the group once the collective beneficial ownership among group members exceeds [5%] of a covered class.”

Additionally, the proposed changes clarify certain circumstances under which two or more persons may engage in conduct without becoming subject to group reporting requirements. Notably, the proposed amendments exempt investors that communicate with other shareholders, or the issuer, from “group” status when such communications are not undertaken with the purpose or effect of changing or influencing control of the issuer.

A version of this article was originally published as a client alert on February 14, 2022.

Private Fund Advisers; Documentation of Compliance Reviews

On February 9, 2022, the SEC proposed material changes to the way private fund advisers are regulated under the Advisers Act. The SEC notes in its press release that the new rules and amendments would “protect private fund investors by increasing transparency, competition, and efficiency in the $18-trillion marketplace.”

As proposed, these changes would require all private fund advisers to enhance investor disclosures related to fees, expenses and investment performance through standardized quarterly statements, for the stated purpose of increasing transparency. In addition, the proposal would further add to the existing audit and record-keeping burdens of private fund advisers in order to increase regulatory oversight and review as well as investor knowledge and information regarding their investments in private funds.

In addition to the new requirements imposed on private fund advisers, the proposal includes express restrictions and prohibited activities. Specifically, as proposed, private fund advisers would be prohibited from, among other things: providing preferential treatment to fund investors unless such treatment is adequately disclosed; seeking certain redress, limitations on liability, indemnification and certain reimbursements related to regulatory examinations or unperformed services; charging investors on a non-pro rata basis; and borrowing funds or accepting credit from an investor.

Finally, the proposal seeks to adopt a formal requirement that compliance reviews under Rule 206(4)-7 of the Advisers Act be documented in writing.

The comment period for this proposal reopened on May 9, 2022. In referencing the extension, SEC Chair Gary Gensler noted that “the proposal has drawn significant interest from a wide breadth of investors, issuers, market participants and other stakeholders.”

Amendments to Form PF

On January 6, 2022, the SEC proposed significant amendments to Form PF, including by adding new reporting obligations for large private fund advisers, lowering the threshold for large private equity reporting obligations from $2 billion to $1.5 billion in assets under management and imposing increased reporting obligations related to short-term financing markets for large liquidity fund advisers.

As adopted, the proposal’s most significant change would require large hedge fund and private equity advisers to disclose information related to certain “reporting events,” such as “extraordinary investment losses,” “significant margin and counterparty default events” and other material matters, within one business day of the occurrence of such event. At present, reporting obligations are tied to the size and type of funds that are advised, with most reporting on Form PF more than 30 days after the end of a quarter year. According to the SEC, the changes are designed to provide the Financial Stability Oversight Council with timely information necessary to assess systemic risk posed by the private fund industry.

Money Market Fund Reforms Modernization

On December 15, 2021, the SEC proposed amendments to rules governing money market fund activities under the 1940 Act. The proposal comes, according to the SEC, in response to money market performance issues during the March 2020 market sell-off and is designed to “improve the resilience and transparency of money market funds.”

As adopted, the proposal would eliminate redemption fees and gates that have the potential to incentive “preemptive redemptions” during periods of stress. The proposal also seeks to force institutional prime and institutional tax-exempt money market funds to utilize swing pricing policies and procedures, which, according to the proposal release, would “require redeeming investors to bear the liquidity costs of their decisions to redeem.” These material changes, combined with the proposal to increase daily and weekly liquidity asset minimums to 25% and 50%, respectively, are designed to increase the buffer available to money market funds during periods of significant stress and redemptions.

Shortening the Securities Transaction Settlement Cycle

On February 9, 2022, the SEC announced risk-based rule proposals to amend securities clearing and settlement processes. Specifically, the proposals would shorten the settlement cycle for most broker-dealer transactions from T+2 (two business days after trade date) to T+1 (one business day after trade date). The SEC notes in its press release that the “changes are designed to reduce credit, market, and liquidity risks in securities transactions faced by market participants and U.S. investors.”

In addition to the formal shortening of the standard settlement cycle, the proposal would mandate market participants, specifically broker-dealers and investments advisers, to process transaction confirmations, affirmations and allocations as soon as technologically practicable, and clearing agencies would be required to seek straight-through processing and automated matching of transactions.

While the SEC notes the proposal is designed to reduce market and liquidity risks, it is unclear what the collateral impact will be on market participants, particularly when it comes to securities lending activities, timely recalls of borrowed shares, existing contractual commitments between counterparties, and the general unwinding of certain structured products and equity-backed derivatives. It is also unclear to what extent this will impact liquidity classifications for investment company reporting purposes.

Short Position and Short Activity Reporting by Institutional Managers

On February 25, 2022, the SEC announced that it had unanimously voted to approve proposed changes requiring certain institutional investment managers7 (managers) to report information related to short sales to the SEC. Proposed Rule 13f-2 under the Exchange Act would require managers exercising investment discretion over short positions that exceed certain thresholds to file with the SEC new Form SHO to report certain information relating to month-end short positions and certain related daily activity. The filing would not be public. The SEC would then take the details provided in the form and publish aggregate information on large short positions related to individual equity securities and net activity during the applicable month. This information is intended to supplement the current short-sale transaction information provided by major U.S. stock exchanges and the Financial Industry Regulatory Authority (FINRA).

Ultimately, proposed Rule 13f-2 seeks to address Congress’ directive under Section 929X of the Dodd-Frank Act to provide more transparency of short selling. SEC Chair Gary Gensler stated that proposed Rule 13f-2 “would strengthen transparency of an important area of our markets that would benefit from greater visibility and oversight.” If adopted, this new rule would make significant changes to short-selling disclosure obligations for managers in the SEC’s effort to provide more insight on large short sellers’ behavior and mitigate stock price manipulation during times of irregular market volatility. Key aspects of the proposed changes are described in further detail in our March 17, 2022, client alert “SEC Proposes Short Sale Disclosure Rules.”

Share Repurchase Disclosure Modernization

Currently, companies are required to make periodic disclosures of all open market and private repurchases of equity securities by the company or an affiliated purchaser. This proposal would significantly alter the current disclosure framework for companies, foreign private issuers and certain registered closed-end funds, requiring next-business-day disclosure of repurchases on a new Form SR and enhancing the existing disclosure requirements.

For more, see our December 20, 2021, client alert “SEC Announces Proposals Relating to Rule 10b5-1, Share Repurchases and Other Matters.”

Rule 10b5-1 and Insider Trading

Rule 10b5-1 under the Exchange Act provides an affirmative defense to insider trading for individuals and companies that trade stocks under plans entered into in good faith and at a time when the individual or company does not possess material nonpublic information. The amendments to Rule 10b5-1 proposed by the SEC would add new conditions to the availability of the affirmative defense to insider trading liability provided by Rule 10b5-1 trading plans.

For more, see our December 20, 2021, client alert “SEC Announces Proposals Relating to Rule 10b5-1, Share Repurchases and Other Matters.”

2022 Compliance Dates for Recently Adopted Final Rules

Good Faith Determinations of Fair Value Under the 1940 Act

On September 8, 2022, registered investment companies and business development companies must begin complying with the SEC’s new and “modernized” good faith fair valuation framework, Rule 2a-5 under the 1940 Act (the Rule), related to fund holdings.

With less than four months remaining until the mandatory compliance date, funds and their boards should be positioned to formally adopt and implement required changes to their compliance policies and procedures related to their fair valuation methodologies. These include functions contemplated by the rule to periodically assess material risks associated with making fair valuation determinations, establishing and applying effective methodologies, developing testing procedures to ensure accuracy and appropriateness, and managing the board reporting and oversight of the valuation designee (if applicable) and any pricing services that are used for inputs in the process.

For more, see our article “SEC Division of Investment Management Staff Statement on Cross Trading” in the June 2021 issue of this newsletter.

Use of Derivatives by Registered Investment Companies and Business Development Companies

On August 19, 2022, registered investment companies and business development companies must begin complying with the SEC’s new derivatives risk management framework, Rule 18f-4 under the 1940 Act (the Rule), related to funds’ use of, or participation in, derivatives transactions contemplated by the Rule.

With just over three months remaining until the mandatory compliance date, funds and their boards should be positioned to formally adopt and implement required changes to their compliance policies and procedures related to their management of derivatives risk and the framework articulated by the Rule. These include, where relevant, ensuring that: implemented changes meet or exceed the required scope of a comprehensive derivatives risk management program set forth in the rule; any calculations related to eligibility determinations for limited derivatives users are verified for accuracy and approved by fund boards, where appropriate; and any policies and procedure related to testing and reporting have been reasonably designed to prevent, detect and correct violations of the Rule, consistent with existing compliance obligations under the 1940 Act’s compliance rule, Rule 38a-1.

For more, see our article “SEC Division of Investment Management Information Update on Rule 18f-4” in the June 2021 issue of this newsletter.

Investment Adviser Advertisements; Compensation for Solicitations

On November 4, 2022, investment advisers that are registered or required to be registered with the SEC must begin complying with amended Rule 206(4)-1 under the Advisers Act, the primary principles-based rule set to govern the advertising and solicitation activities of advisers subject to Section 203 of the Advisers Act.

With less than six months remaining until the mandatory compliance date, registrants and those that are registering or required to be registered with the SEC should be positioned to formally adopt and implement required changes to their compliance policies and procedures related to their advertising activities. These include, to the extent relevant, activities related to the calculation and presentation of any hypothetical, back-tested model or extracted performance. Registrants should also review and amend, to the extent necessary, agreements and disclosures governing solicitation activities, third-party endorsements, ratings and promoter functions.

For more, see our article “SEC Adopts Modernized Marketing Rule for Investment Advisers” in the June 2021 issue of this newsletter.

Regulation, Disclosure and Exams

SEC Investment Management Director Delivers Remarks at Investment Company Institute Conference

On March 28, 2022, William Birdthistle, the SEC’s new director of the Division of Investment Management, delivered prerecorded remarks at the Investment Company Institute’s 2022 Investment Management Conference. In his address to industry professionals, the director raised concerns that fund investors do not currently have the sufficient tools and resources necessary to independently evaluate their fund investments on an ongoing basis, making an express reference to funds that underperform relative to their peer group and benchmark, and that charge above-average management fees.

In framing his concerns, Mr. Birdthistle focused on the negative impact of this perceived lack of resources on investors that have ready access to purchase these underperforming funds but too few tools (including information) to help them, on an equivalent basis, make evaluations and exit their positions. In this context, Mr. Birdthistle referenced Section 36(b) of the 1940 Act as both a private right of action option for investors and enforcement option for the SEC, noting, however, that no plaintiff has prevailed in a private claim. In referencing the fail rate of private litigants bringing actions under Section 36(b), Mr. Birdthistle discussed the SEC’s power and authority to bring actions under Section 36(b), again in the context of underperforming, higher-fee funds.

In light of these comments, boards should remember that the annual evaluation process for renewing a fund’s advisory contract is an ongoing obligation to be approached with a critical eye and sound process to execute a critical function for the benefit of shareholders.

Russia-Ukraine War

As a result of Russia’s military invasion of Ukraine in February 2022, the U.S. and other countries imposed broad-reaching political and economic sanctions on Russia, certain Russian allies believed to be providing them military or financial support, private and public companies domiciled in Russia (including public issuers and banking and financial institutions) and a variety of individuals.8

Related Disclosure Obligations

According to the SEC staff, market participants should evaluate their existing disclosures in the context of their legal, regulatory and contractual obligations to clients and investors to determine whether specific disclosures related to the conflict are necessary. While market participants with direct exposure to investments in Russia or in Russian-backed currencies may have a more obvious and direct obligation to disclose risk factors related to their portfolio holdings, the SEC staff has indicated that all registrants should consider the indirect consequences that the ongoing conflict and resulting sanctions may have on their company and portfolio, performance and ability to implement investment mandates consistent with existing disclosure, as well as other risk factors triggered by the conflict.

Stated differently, the SEC staff also appears to be suggesting that it is not possible to predict the duration or extent of longer-term consequences of this conflict, which could include further sanctions, retaliatory measures taken by Russia, embargoes, regional instability, geopolitical shifts and adverse effects on macroeconomic conditions, security conditions, currency exchange rates and financial markets around the globe. Any of the foregoing consequences, as well as others that market participants cannot yet predict, may negatively impact operating companies and investment companies, even absent direct exposure to Russian issuers or to issuers in other countries affected by the invasion. The SEC staff appears to be reminding registrants that they should consider the impacts of these potential consequences in evaluating the scope and content of their public disclosures.

Cybersecurity Preparedness, Disaster Recovery and Operational Resiliency

Given the uncertain nature and outcome of the conflict, as well as the unpredictability of retaliatory responses from Russia in the wake of new and existing sanctions, and the responses from its allies, sympathizers or other rogue actors, the SEC staff makes express note of the fact that market participants may need to evaluate the strength and resiliency of their cybersecurity and disaster preparedness and make related disclosures. More specifically, firms may need to review their data storage, backup practices, remote capabilities and whether policies and procedures are sufficiently adequate to safeguard client information during periods of substantial disruption and threats to the global cyber-infrastructure and digital communications channels.

Cryptocurrency and Digital Assets Update

Staff Accounting Bulletin No. 121

On March 31, 2022, the SEC’s Division of Corporation Finance and the Office of the Chief Accountant (Staff) published Staff Accounting Bulletin No. 121 (SAB 121), which provides guidance concerning accounting and disclosure obligations for companies that provide a platform for users to transact in digital assets9 and safeguard those assets on behalf of customers. Specifically, SAB 121 provides that affected companies should record digital assets as liabilities on their balance sheets (accounted at fair value) and disclose the nature and amount of the digital assets held by the company, as well as related risks. SAB 121 states that “[t]he obligations associated with these arrangements involve unique risks and uncertainties not present” in arrangements to safeguard nondigital assets.

Subject to certain transition periods, the guidance in SAB 121 will apply to: reporting companies under the Exchange Act; companies that have submitted or filed a registration statement under the Securities Act of 1933; companies reporting under, or that have submitted offering statements under, Regulation A; and private operating companies whose financial statements are included in filings with the SEC in connection with a business combination involving a shell company, including a special purpose acquisition company (SPAC).

For more, see our April 4, 2022, client alert “SEC Staff Issues Digital Asset Accounting Guidance.”

President Biden’s Executive Order

On March 9, 2022, President Joe Biden signed a first-of-its-kind executive order directing federal agencies to collaborate on a cohesive approach to digital assets, including an exploration of the pros and cons, and legislative and technical requirements for creating a federal digital currency, also known as a central bank digital currency (CBDC). The order comes at a time of increasing scrutiny by regulators and the media as to how cryptocurrencies might be used to evade sanctions or for other improper means.

The overall tone of the executive order is receptive to the use of digital assets, provided it is done in a way that protects individuals and entities in areas including data privacy and security, financial stability and systemic risk, crime, national security, human rights, financial inclusion and equity, and energy demand and climate change. As discussed below, a good portion of the order is dedicated to mandating various reports that government departments and agencies need to generate on different aspects of the digital asset space. This likely means that over the course of 2022 there will be greater clarity for digital asset stakeholders about the U.S. government’s policy posture toward digital assets, which would be a net positive for the industry as a whole.

For more, see our March 10, 2022, client alert “Executive Order Aiming To Coordinate Digital Assets Policies May Bring Much-Needed Clarity.”

Recent Enforcement Action

In February 2022, the SEC charged a large digital assets market participant with violating the registration provisions of the Securities Act and the 1940 Act.

According to the SEC, the company failed to register the offers and sales of its crypto lending program and operated as an unregistered investment company when it issued securities and held more than 40% of its total assets (excluding cash but including loans of digital assets) in securities.

The SEC also announced that the company, without admitting or denying the SEC’s findings, had agreed to pay a $50 million penalty, pay $50 million in related fines, cease and desist unregistered activities related to its lending product, and seek to bring its products within the registration provisions of the federal securities laws.

SEC Nearly Doubles Size of Enforcement’s Crypto Assets and Cyber Unit

On May 3, 2022, the SEC announced it was adding 20 new staff positions to the Crypto Assets and Cyber Unit (the Unit), which is tasked with regulating crypto markets and cyber-related market threats. In referencing the expansion of the Unit, Gurbir S. Grewal, director of the SEC’s Division of Enforcement, noted that the added resources will enable the Unit to be “at the forefront of protecting investors and ensuring fair and orderly markets,” particularly in light of the fact that “[c]rypto markets have exploded in recent years, with retail investors bearing the brunt of abuses in this space.”

The release suggests the SEC is continuing to try and position itself in a leadership role in the regulation of digital assets. It notes expressly that the Unit will investigate potential securities law violations across the digital assets space, including those related to offerings, exchanges, products, platforms, tokens and coins.

Division of Examinations Initiatives

On March 30, 2022, the SEC’s Division of Examinations (Examinations) released its 2022 Examination Priorities (the alert). As it does every year, the document includes an overview of significant focus areas the staff at Examinations deems essential to review in the current market environment as well as a selection of priorities related to different areas of the market and market participants. These include, among others not addressed in this newsletter, investment advisers, investment companies, business development companies and broker-dealers.

Significant Focus Areas

Private funds. As always, the alert indicates Examinations will focus on: private fund advisers’ compliance programs, how advisers discharged their fiduciary duties and practices related to fees, billing, expenses and expense reimbursement, custody rule compliance, valuation of portfolio holdings, and disclosures relating to conflicts of interest. In addition, the alert notes that private fund advisers may be asked to provide information associated with trading, allocation and practices that have, or appear to have, systemic importance.

ESG investing. The alert indicates Examinations intends to place substantial emphasis on advisory services relating to environmental, social and governance (ESG) investing, including registered and private fund offerings. Specifically, the alert notes that Examinations will focus on the accuracy of ESG-related disclosures, representations and investment mandates as well as the adequacy of policies and procedures designed to prevent violations of federal securities laws in connection with ESG-related investment practices and portfolio management activities.

Standards of conduct. In line with the previous examination cycle following adoption of Regulation Best Interest (Reg BI), the alert indicates that Examinations will focus on registrants’ (including investment advisers and broker-dealers) exercise of standards of care relevant to the services offered to retail investors. Specifically, the alert indicates that Examinations will assess whether broker-dealers have satisfied their obligations under Reg BI and whether investment advisers have discharged their fiduciary duties when managing accounts, conflicts of interest, trading practices, disclosure activities and account-type recommendations.

Information security and operational resiliency. Unsurprisingly, the alert indicates that registrants may also be asked to demonstrate measures taken to safeguard customer accounts, confidential information, prevent cybersecurity related incidents, supervise remote and dispersed workforces, and ensure vendors and key service providers are positioned to manage operational risks and business continuity.

Emerging technologies and cryptoassets. According to the alert, Examinations will focus on registrants’ use of new and emerging financial technologies in their businesses, specifically the design of compliance programs’ effectiveness in addressing the unique risks posed by these new products — including when used in the formulation of investment advice for client accounts as well as when storing or transmitting customer records and confidential information. Relatedly, the alert indicates Examinations will place heavy emphasis on reviewing the compliance programs and risk controls of registrants participating in crypto markets or that are utilizing digital ledgers and digital asset custodians in the management of their client accounts.

Registrant-Specific Examination Programs

Investment advisers. Like most years, the alert notes that Examinations is poised to focus on never-before-examined advisers, adviser conduct and fiduciary duty, particularly in areas of disclosure, conflicts of interest, investment recommendations, the fair and equitable allocation of trades, and all issues related to billing, fee calculations, aggregating household accounts and determining breakpoints, and when issuing refunds, rebates and restitution consistent with disclosures and in accordance with the terms of governing documents, such as the adviser’s client agreement. In addition, the alert notes that Examinations may assess the adequacy of resources devoted to compliance, the effectiveness of third-party service provider oversight, and the design of policies and procedures that address areas of heightened risks, such as supervision of multiple branch offices, individuals with disciplinary disclosures, and risks associated with migrating account types or offering alternative products.

New this year for advisers is the alert’s reference to Examinations’ substantial emphasis on advisers’ use of alternative data and data gleaned from nontraditional sources in the formulation of investment analysis. More specifically, and as announced in an April 26, 2022, risk alert identifying “notable deficiencies” related to Section 204A of the Investment Advisers Act of 1940 and Rule 204A-1 thereunder, Examinations intends to continue reviewing the adequacy of policies and procedures related to advisers’ receipt of material nonpublic information (MNPI) obtained through alternative data sources, including their diligence processes and the consistency of diligence conducted on service providers. Further, the alert indicates that Examinations will continue assessing weaknesses in programs for advisers that make use of information obtained from “value-add investors,” “expert networks” and other investors that are more likely to possess MNPI, and will specifically look at controls designed to track the data and unique risks such relationships pose.

Investment companies and business development companies. The alert indicates Examinations may continue to evaluate trading of portfolio assets and whether funds have adequate policies and procedures to prevent and detect trading practices designed to inflate performance, such as window dressing.

According to the alert, funds may also receive inquiries related to the adequacy and effectiveness of their liquidity risk management programs, including related risk disclosures and the valuation methods employed by funds investing in private funds and other less liquid investments, particularly those that do not have a readily available market quotation.

The alert also notes that Examinations may focus on open-end funds’ advisory fee waiver practices and whether these funds have determined the sustainability of such waivers. For business development companies, the alert indicates there may be emphasis on policies and procedures surrounding management of conflicts of interest (and related disclosures) with underlying portfolio companies, their marketing activities, if any, and general valuation practices. And finally, the alert references Examinations of money market funds and the focus on stress testing programs, consistency and accuracy of website disclosures, and whether the boards of money market funds are maintaining adequate oversight of their liquidity risk management programs and potential systemic risks.

Broker-dealer examination program. Like most years, the alert indicates Examinations intends to focus on broker-dealers that maintain custody of customer cash and securities, particularly as it relates to their safeguarding obligations pursuant to Rule 15c3-3 under the Exchange Act (also known as the Customer Protection Rule). Also consistent with previous years, the alert notes that broker-dealer practices will be reviewed to assess compliance with large trader reporting requirements as well as with the aggregation-and-locate requirements under Regulation SHO.

According to the alert, broker-dealers should also be prepared to demonstrate evidence of adequate liquidity risk management policies and procedures, specifically as they relate to significant stress events and testing the firm’s ability to continue meeting minimum net-capital requirements during such periods. Finally, the alert notes that Examinations may focus on registered broker-dealers offering zero-commission products; Rule 606 order routing policies, procedures and related disclosures; and whether broker-dealers have evidenced reviews of conflicts of interest associated with order routing and execution of trades in customer accounts.

LIBOR transition. In addition to the focus areas for advisers, investment companies, business development companies and broker-dealers, the alert indicates that Examinations will focus on firms impacted by the London Interbank Offered Rate (LIBOR) transition, in particular on compliance with obligations of firms that recommend LIBOR-linked products, firms that have significant exposure to LIBOR and what steps firms have taken to transition to an alternative reference rate.

Associate Joshua N. Breen contributed to this update.

______________________________________

1 Control share acquisition statutes, SEC Division of Investment Management Staff Statement (May 27, 2020).

2 No. 21-CV-327 (S.D.N.Y. Feb. 17, 2022) (finding adoption of a control share bylaw by a closed-end fund organized as a Massachusetts business trust violated Section 18(i) of the 1940 Act).

3 See Nuveen at 6-7 (rejecting an argument to defer to the 2020 SEC staff statement, in part because the facts involved a control share bylaw rather than a control share statute).

4 Most closed-end funds are organized as Maryland corporations, Maryland statutory trusts, Delaware statutory trusts or Massachusetts business trusts. Presently, of these forms of organization, only a Maryland corporation has an express statutory control share scheme to opt in to.

5 Assuming, for the sake of argument here, that Section 18(i)’s requirements mean what the Nuveen court asserted they mean.

6 The SEC has explained that security-based swaps are excluded from the proposed changes because recently proposed Rule 10B-1 “would provide sufficient information regarding holdings of security-based swaps such that additional regulation under Regulation 13D-G … would be unnecessarily duplicative,” as detailed in our January 21, 2022, client alert “SEC Proposes New Disclosure Rule for Security-Based Swap Positions.”

7 Under Section 13(f)(6)(A) of the Exchange Act and for purposes of Proposed Rule 13f-2, “institutional investment managers” include “any person, other than a natural person, investing in or buying and selling securities for its own account, and any person exercising investment discretion with respect to the account of any other person” (e.g., investment advisers, banks, insurance companies, broker-dealers, pension funds, corporations, etc.).

8 This article is for informational purposes only and does not constitute legal advice. Complex assessments often have to be made as to which sanctions regime applies in any given instance, given the multinational touch points of many entities and individuals. In that regard, given the complex and dynamic nature of these sanctions regimes, there may be developments not captured in this summary. Moreover, while the summary was accurate when written, it may become inaccurate over time given developments. For all of these reasons, you should consult with a qualified attorney before making any judgments relating to sanctions, as there are potentially severe consequences of failing to adhere fully to sanctions restrictions.

9 SAB 121 refers to “crypto-assets,” which is defined as “a digital asset that is issued and/or transferred using distributed ledger or blockchain technology using cryptographic techniques.”

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.