On August 17, 2017, the staff (Staff) of the Securities and Exchange Commission (SEC) issued new guidance that will streamline significantly the confidential submission process for emerging growth companies (EGCs) and non-EGCs conducting initial public offerings (IPOs). The guidance effectively eliminates the circumstances under which an issuer will need to include interim period financial statements in its initial draft registration statement and certain subsequent amendments. The Staff also updated its June 29, 2017, announcement, which had expanded the class of issuers and transactions eligible to submit draft registration statements for nonpublic review,1 to clarify that an issuer that has a public registration statement on file that is not yet effective may conditionally switch to the nonpublic review process for future amendments to its registration statement.

The new guidance, which is effective immediately, reflects continued efforts by the SEC under new Chairman Jay Clayton and Division of Corporation Finance Director William Hinman to encourage IPOs and generally ease the regulatory burdens on the formation of public capital.

New Guidance Regarding Omission of Interim Financial Statements

The Staff issued new and updated compliance and disclosure interpretations (C&DIs) that permit EGCs and non-EGCs conducting IPOs, follow-on offerings within one year of the company’s IPO and initial registrations under the Securities Exchange Act to confidentially submit draft registration statements that omit interim financials (and the related management discussion and analysis (MD&A) disclosure) that they reasonably believe will not be required to be presented separately at the time they launch their public offering, in the case of EGCs, and file publicly, in the case of non-EGCs and any issuer conducting an initial Securities Exchange Act registration.2 This significant development reverses prior Staff guidance under the Fixing America’s Surface Transportation (FAST) Act that EGCs could not exclude from any registration statement the most recent interim period required by Regulation S-X, even if that period would have been replaced with a longer interim or annual period in the registration statement at the time of the offering.

For IPOs, where the time to market often is four months or longer, the new Staff policy effectively means that interim financial statements (and the related MD&A discussion) no longer will be required in any initial draft registration statement and, depending on the timing of the transaction, in certain subsequent amendments to the draft registration statement. This change will provide issuers and their advisers significantly more flexibility in planning the IPO, including the ability to commence (and hopefully complete) the SEC review process faster than had been previously possible because they will be able to submit the initial draft registration statement earlier in the process.

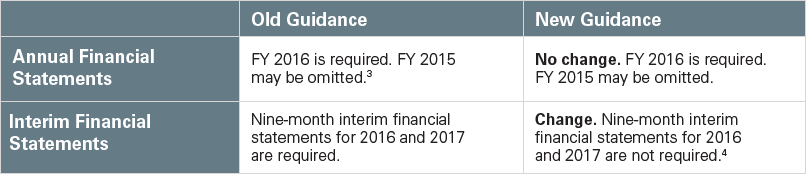

To illustrate the impact of the new policy, consider the example of a calendar year-end domestic EGC that submits a draft IPO registration statement in December 2017 and reasonably expects to publicly file and commence its offering in April 2018 when annual financial statements for 2017 and 2016 will be required.

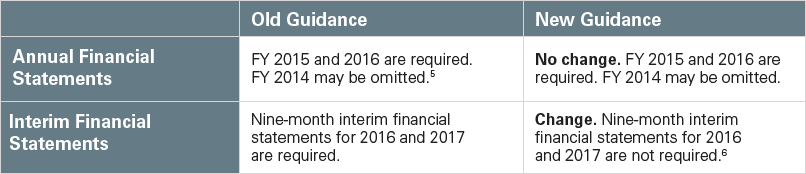

The result is similar if the issuer is a calendar year-end domestic non-EGC that submits a draft IPO registration statement in December 2017 and reasonably expects to publicly file and commence its offering in April 2018 when annual financial statements for 2017, 2016 and 2015 will be required.

As was the case under the prior Staff guidance, however, any publicly filed registration statements may not omit interim financial information (and the related MD&A discussion) that will be part of a longer historical period — either interim or annual — that the issuer will include at the time it launches its public offering, in the case of an EGC, and files publicly, in the case of a non-EGC and any issuer conducting an initial Securities Exchange Act registration. Issuers must keep this principle in mind when considering whether a publicly filed registration statement that will precede the preliminary prospectus used to market the offering must contain interim financial statements.

To illustrate this point, consider the earlier example of a calendar year-end domestic EGC that submits a draft IPO registration statement in December 2017 and reasonably expects to commence its offering in April 2018 when annual financial statements for 2017 and 2016 will be required. If the issuer were to publicly file in early January 2018 (as compared to April 2018), it would be required to include nine-month interim financial statements for 2016 and 2017, as that financial information will be part of the historical periods that will be included at the time the issuer commences the public offering.

The relevant C&DIs are copied below in Annex A (and also can be found here and here).

New Guidance Regarding Issuers and Transactions Eligible to Submit Draft Registration Statements

The Staff updated its June 29, 2017, announcement to clarify that an issuer that has a public registration statement on file (including a registration statement currently under active Staff review) may switch to the nonpublic review process for future pre-effective amendments to its registration statement. This is the case so long as the issuer is eligible to participate in the nonpublic review process and it agrees to publicly file its amended registration statement and all draft amendments in accordance with the time frames specified in the Staff announcement, i.e., (i) in the case of an IPO or initial Securities Exchange Act registration statement, at least 15 days prior to any roadshow or, in the absence of a roadshow, at least 15 days prior to the requested effective date of the registration statement, or (ii) in the case of a qualified follow-on offering, at least 48 hours prior to any requested effective time and date. A copy of the Staff announcement, as updated, is available here.

* * *

Annex A

FAST Act C&DIs, Updated Question 1 (duplicated in Securities Act Forms C&DI 101.04)

Question: What financial information may an Emerging Growth Company omit from its draft and publicly filed registration statements?

Answer: Under Section 71003 of the FAST Act, an Emerging Growth Company may omit from its filed registration statements annual and interim financial information that “relates to a historical period that the issuer reasonably believes will not be required to be included…at the time of the contemplated offering.” Interim financial information that will be included in a longer historical period relates to that period. Accordingly, interim financial information that will be included in a historical period that the issuer reasonably believes will be required to be included at the time of the contemplated offering may not be omitted from its filed registration statements. However, under staff policy, an Emerging Growth Company may omit from its draft registration statements interim financial information that it reasonably believes it will not be required to present separately at the time of the contemplated offering.

For example, consider a calendar year-end Emerging Growth Company that submits a draft registration statement in November 2017 and reasonably believes it will commence its offering in April 2018 when annual financial information for 2017 will be required. This issuer may omit from its draft registration statements its 2015 annual financial information and interim financial information related to 2016 and 2017. Assuming that this issuer were to first publicly file in April 2018 when its annual information for 2017 is required, it would not need to separately prepare or present interim information for 2016 and 2017. If this issuer were to file publicly in January 2018, it may omit its 2015 annual financial information, but it must include its 2016 and 2017 interim financial information in that January filing because that interim information relates to historical periods that will be included at the time of the public offering. See also Question 101.05 for guidance related to registration statements submitted or filed by non-EGCs.

Securities Act Forms C&DIs, New Question 101.05

Question: What financial information may an issuer that is not an Emerging Growth Company omit from its draft and publicly filed registration statements?

Answer: The relief provided by Section 71003 of the FAST Act is not available to issuers other than Emerging Growth Companies. However, under staff policy, an issuer that is not an Emerging Growth Company may omit from its draft registration statements interim and annual financial information that it reasonably believes it will not be required to present separately at the time it files its registration statement publicly. The issuer may not omit any required financial information from its filed registration statements.

For example, consider a calendar year-end issuer that is not an Emerging Growth Company that submits a draft registration statement in November 2017 and reasonably believes it will first publicly file in April 2018 when annual financial information for 2017 will be required. This issuer may omit from its draft registration statements its 2014 annual financial information and interim financial information related to 2016 and 2017 because this information would not be required at the time of its first public filing in April 2018. [Aug. 17, 2017]

_______________________

1 Our client alert on the June 29, 2017, Staff announcement can be found here.

2 The temporal difference between the two standards can be traced to their different origins. The accommodation for EGCs (omitted financial information must be provided “at the time of the contemplated offering”) is contained in the statutory language in the FAST Act; the accommodation for non-EGCs and initial Securities Exchange Act registrations (omitted financial information must be provided “at the time the registration statement is publicly filed”) originates from the July 29, 2017, Staff announcement.

3 The ability of an EGC to omit annual financial statements from its draft registration statement (and, in certain cases, its publicly filed registration statement) is derived from Section 71003 of the FAST Act.

4 See FAST Act C&DIs, Question 1 (Aug. 17, 2017); Securities Act Forms C&DIs, Question 101.04 (Aug. 17, 2017).

5 See Voluntary Submission of Draft Registration Statements – FAQs, Question 7 (June 30, 2017).

6 See Securities Act Forms C&DIs, Question 101.05 (Aug. 17, 2017).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.