On June 28, 2018, the Securities and Exchange Commission (SEC) approved amendments to the definition of “smaller reporting company” (SRC) that will substantially expand the number of companies that will qualify for the scaled disclosure accommodations available to SRCs. The amendments, however, do not modify the existing scope of the scaled disclosure requirements.

As expected, under the new definition, companies will qualify as an SRC if they have less than $250 million of public float or less than $100 million in annual revenues for the previous year and no public float.1 In a change from the proposed rules, companies will also qualify as an SRC if they have annual revenues of less than $100 million for the previous year and a public float of less than $700 million.

In another welcome change from the proposed rules, the SEC amended Rule 3-05(b)(2)(iv) of Regulation S-X to increase the revenue threshold to $100 million from $50 million under which acquirers may omit the earliest of the three fiscal years of audited financial statements of certain acquired businesses.

Under the new definition, companies will qualify as an SRC if they have less than $250 million of public float or less than $100 million in annual revenues for the previous year and no public float.

Finally, the SEC amended the “accelerated filer” and “large accelerated filer” definitions in Rule 12b-2 of the Securities Exchange Act of 1934 (Exchange Act), as proposed, to eliminate the automatic exclusion under those definitions for any company that qualifies as an SRC, thereby preserving the application of the current public float thresholds in those definitions. These definitions were not, however, otherwise substantively modified.

The new rules will become effective 60 days after publication in the Federal Register.

Background

The SEC established the SRC category of companies in 2008 in an effort to provide general regulatory relief for smaller companies. The SRC definition replaced the disclosure requirements formerly found in Regulation S-B, which applied to “small business issuers” and were intended to promote capital formation and reduce compliance costs for smaller issuers. Issuers meeting the definition of an SRC qualify for certain scaled disclosure requirements. For example, SRCs are:

- required to include only two (instead of three) years of income, cash flow and changes in stockholders’ equity statements;

- required to provide only a two-year (instead of a three-year) comparison of management’s discussion and analysis of financial condition and results of operations;

- required to provide only two (instead of three) years of summary compensation table information;

- not required to provide a compensation discussion and analysis (CD&A) or pay ratio disclosure; and

- not required to include risk factors in Exchange Act filings.

The SRC scaled disclosure requirements, like those available to emerging growth companies (EGCs), permit an à la carte approach.2 For example, we expect that many newly eligible SRCs will include risk factor disclosure in their Exchange Act filings even though they are not required to do so.

Under the previous definition, SRCs generally were companies with:

- less than $75 million in public float as of the last business day of their most recently completed second fiscal quarter (Public Float Test); or

- a public float of zero and annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available (Revenue Test).3

Amended Definition: Companies Making an Initial SRC Determination or a Current SRC Re-Evaluating Its Status

Public Float Test

Under the amended definition, companies with a public float of less than $250 million will qualify as SRCs. Consistent with the current definition, a company calculates its public float as of the last business day of its most recently completed second fiscal quarter. A company filing its initial registration statement under the Securities Act or the Exchange Act would calculate its public float as of a date within 30 days of the filing date. For companies filing an initial Securities Act registration statement, public float is calculated by multiplying the estimated public offering price per share at the time of filing by the sum of the number of shares included in the registration statement and the number of shares held by nonaffiliates before the offering.4

Revenue Test

A company with no public float or with a public float of less than $700 million will qualify as an SRC if it had annual revenues of less than $100 million during its most recently completed fiscal year for which audited financial statements are available.

The following table summarizes the amended SRC definition for a registrant making an initial determination or a current SRC re-evaluating its status.

Amended Definition: Non-SRCs Seeking to Qualify as an SRC

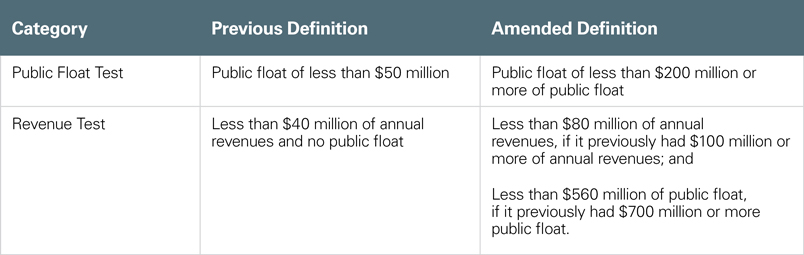

Consistent with the current definition, a company that determines that it does not qualify as an SRC under the initial qualification thresholds will remain unqualified unless and until it determines that it meets one or more lower qualification thresholds. The subsequent qualification thresholds are set at 80 percent of the initial qualification thresholds.

The following table summarizes the amended SRC definition for a non-SRC seeking to subsequently qualify as an SRC.

Amendments to Rule 3-05(b)(2)(iv) of Regulation S-X

The SEC also adopted amendments to Rule 3-05(b)(2)(iv) of Regulation S-X to increase the net revenue threshold in that rule to $100 million from $50 million. As a result, companies (including non-SRCs) may omit from certain registration statements and current reports on Form 8-K financial statements of businesses acquired or to be acquired for the earliest of the three fiscal years otherwise required by Rule 3-05 if the net revenues of that business in its most recent fiscal year are less than $100 million.Accelerated Filer and Large Accelerated Filer Definition

The thresholds for qualifying as an “accelerated filer” and a “large accelerated filer” remain unchanged. As a result, companies with $75 million or more of public float that qualify as SRCs will remain subject to the requirements that apply to accelerated filers, including the timing of the filing of periodic reports and the requirement that accelerated filers provide the auditor’s attestation of management’s assessment of internal control over financial reporting required by Section 404(b) of the Sarbanes-Oxley Act.

SEC Chairman Jay Clayton, however, has directed the staff to formulate recommendations to the SEC for possible additional changes to the “accelerated filer” definition with a view toward reducing the number of companies that qualify as accelerated filers in order to promote capital formation. The SEC would do so by reducing compliance costs for those companies while maintaining appropriate investor protections.

Conclusion

The new rules will substantially expand the number of companies that will qualify for the scaled disclosure accommodations available to SRCs, which should be a welcome development for many companies. While newly eligible SRCs may benefit from cost savings in the form of reduced compliance costs, it is not clear at this point whether the markets will counter some of these savings in the form of higher capital costs tied to less fulsome disclosures, particularly as it relates to financial statements from the issuer, acquired businesses or equity method investees.

____________________

1 Public float is calculated by multiplying the aggregate worldwide number of shares of a company’s voting and nonvoting common equity held by nonaffiliates by the price the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity.

2 While certain disclosure accommodations available to EGCs are limited to the initial public offering process (e.g., abbreviated issuer financial statements), the SRC scaled disclosure accommodations are available to a company for so long as it remains an SRC.

3 A company will have a public float of zero where, for example, it has no public equity outstanding or no market price for its public equity.

4 A company filing an initial Securities Act registration statement that was not determined to be an SRC has the option to redetermine its status at the conclusion of the offering covered by the registration statement based on the actual offering price and number of shares sold.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.