The much-discussed new revenue recognition standards jointly issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) to harmonize revenue recognition standards between U.S. generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) will become effective for annual reporting periods beginning after December 15, 2017.1 As a result, calendar year companies will need to commence reporting under the new standard beginning with their Forms 10-Q for the quarterly period ending March 31, 2018.

Companies that opt to use the full retrospective method need to consider the impact, if any, of the adoption of the new accounting standard on their access to the capital markets.

Adoption Methods

Companies may choose between two adoption methods. Under the modified retrospective method, a company is required to reflect the cumulative impact of the new standard on its financial statements in its first quarter 2018 Form 10-Q, but does not need to revise historical periods that pre-date adoption. Accordingly, the company’s 2017 and 2016 financial statements will not need to be revised at the time it files its 2018 Form 10-K.

Under the full retrospective method, a company is required to revise all historical periods included in the reported financial statements to reflect the new standard. For example, a company that uses the full retrospective method will be required to apply the new standard to its first quarter 2018 financial statements in its Form 10-Q and retrospectively revise the comparable first quarter 2017 financial statements therein. Similarly, in its 2018 Form 10-K, the company will be required to apply the new standard to its 2018 financial statements and retrospectively revise its 2017 and 2016 financial statements therein.

Impact on Form S-3

As a general matter, companies are required to revise previously issued historical financial statements and other affected financial information (e.g., MD&A and selected financial data) to reflect a subsequent change in accounting principle if those pre-change financial statements are required to be included or incorporated by reference into a new registration statement (with general exception of Form S-8) along with financial statements covering a period during which the accounting change occurred.2 This means that companies that use the full retrospective method to adopt the new revenue recognition standard will be required to provide retrospectively revised historical financial statements and other affected financial information in any new Form S-3 or Form F-3 that includes financial statements covering a period reflecting adoption of the new standard (i.e., first quarter 2018 or later). Companies that use the modified retrospective method to adopt the new revenue recognition standard will not face similar speedbumps when filing a new Form S-3 or Form F-3 because the modified retrospective method will not require any retrospective revision of pre-change historical financial statements.

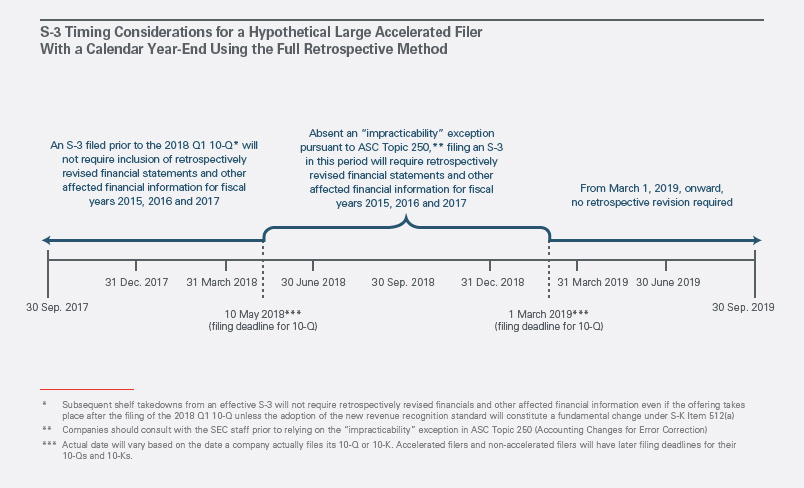

As set forth below in Illustration A, a company that adopts the new revenue recognition standard under the full retrospective method as of January 1, 2018, will be required to retrospectively revise its 2017, 2016 and 2015 financial statements and other affected financial information to reflect the new standard in a Form S-3 filed after its first-quarter 2018 Form 10-Q is filed with the SEC. Typically, this would be accomplished by filing a Form 8-K under Item 9.01 to include the revised financial statements and other affected financial information as an exhibit. The Form 8-K automatically would be incorporated by reference into the Form S-3. It should be noted that the company in this example will be required to retrospectively revise its 2015 financial statements and other affected financial information even though it would not otherwise be required to retrospectively revise this “fourth year” of financial statements and other affected financial information at the time of filing its 2018 Form 10-K.

As noted above in

Next Steps

Companies that have determined to adopt the new revenue recognition standard using the full retrospective method that have an effective Form S-3 that will expire after the first quarter 2018 Form 10-Q, or that otherwise plan to file a Form S-3 after such date, should consider the benefits of filing the new Form S-3 in advance of filing the first quarter 2018 Form 10-Q to avoid the time and expense of including retrospectively revised financial statements and other affected financial information in the Form S-3.

__________________

1 The new common revenue recognition standard is set forth in Accounting Standards Update No. 2014-09, “Revenue From Contracts With Customers (Topic 606),” and IFRS 15, “Revenue From Contracts With Customers.”

2 See generally SEC Financial Reporting Manual, at Topic 13, “Effects of Subsequent Events on Financial Statements Required in Filings.” The exception for Form S-8 is discussed in the Note to Section 13100.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.