On March 4, 2020, the Securities and Exchange Commission (SEC) announced proposed amendments to the exempt offering framework. The proposals target harmonization, simplification and improvement of the existing rules and address comments received after the SEC’s June 2019 concept release. If adopted, exempt offerings would retain much of their fundamental structure, but move incrementally towards expanding capital access and investment opportunities for issuers and investors respectively.

Some of the key proposals would:

- establish “integration safe harbors” to clarify when the SEC will consider multiple offers part of the same offering for the purpose of determining compliance with applicable securities regulations;

- provide greater clarity around communications issues in an exempt offering context, and expand the scope for “testing-the-waters” and “demo day” communications, that, pursuant to the proposal, would not violate the prohibitions on general solicitation;

- increase the maximum offering size and/or investment limits for Regulation A, Regulation Crowdfunding and Rule 504 offerings to increase the benefits of these exemptions to both issuers and investors;

- simplify and harmonize existing rules, such as those surrounding bad actor qualifications, information requirements for nonaccredited investors under Rule 506(b) and verification requirements under Rule 506(c).

The comment period for the proposal will remain open for 60 days following publication in the Federal Register.

Updating the “Integration” Framework

Integration describes the circumstances where the SEC will assess two or more nominally separate offerings and combine them for the purposes of determining whether the issuer complied with applicable offering restrictions. Integration of multiple offerings, especially if the offerings were conducted pursuant to different exemptions, would typically result in the combined offering failing to satisfy the requirements of any exemption. Historically integration of exempt offerings had been determined by the five-factor test, which did not assign any particular weight to each factor or indicate how many factors need to be present to constitute integration.

This began to change with the Regulation A and Regulation Crowdfunding rulemakings in 2015 and the Rule 147 and Rule 147A rulemaking in 2016, where the SEC introduced a facts-and-circumstances assessment to the integration framework in the context of concurrent exempt offerings. The facts-and-circumstances integration framework includes situations where one offering permits general solicitation and the other does not as well as situations where both offerings rely on exemptions permitting general solicitation. The proposed rules build on this framework and provide comprehensive guidance applicable to all securities offerings under the Securities Act, including registered and exempt offerings.

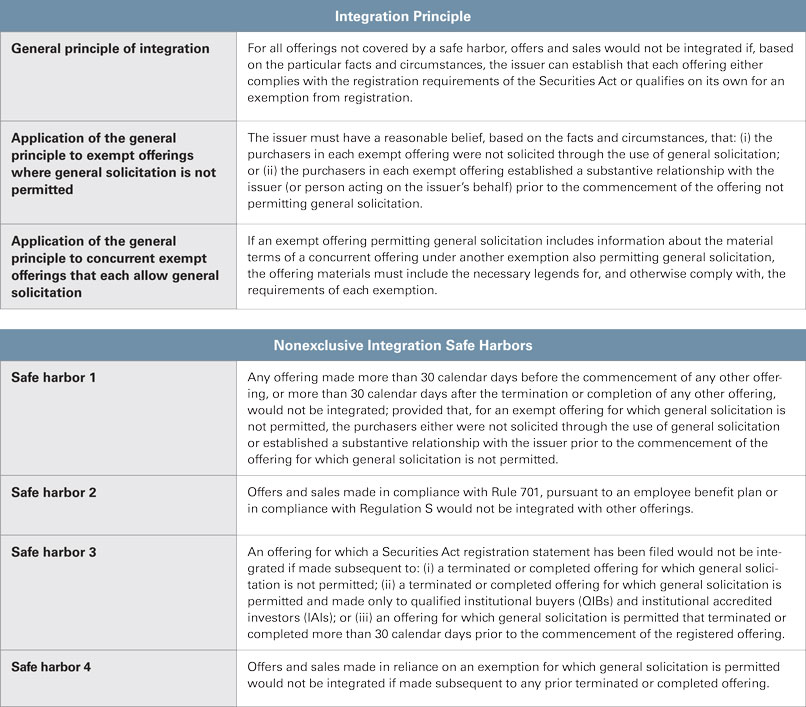

The proposed integration framework provides a general principle of integration that assesses the particular facts and circumstances of the offering and focuses analysis on whether the issuer can establish that each offering either complies with the registration requirements of the Securities Act or qualifies on its own for an exemption from registration. The SEC release illustrates application of the general principle to two specific fact patterns and proposes four nonexclusive safe harbor integration provisions. The following tables, excerpted from the release, provide an overview of the proposed general integration principle and safe harbors.

Overview of the Proposed General Integration Principle and Safe Harbors

The proposed integration framework and safe harbor provisions would be set forth in new Rule 152, which would replace (i) current Rules 152 and 155 concerning the integration of nonpublic and public offerings and (ii) the integration provisions of Regulation D, Regulation A, Regulation Crowdfunding and Rules 147 and 147A.

Reducing Limitations on Communications During the Offering Process

The SEC has also proposed expanding the scope of permissible communications in private offerings. In testing-the-water communications, an issuer may engage in oral or written communications with eligible investors to gauge potential interest in an offering before or after filing a registration statement for that offering. Emerging growth companies first benefitted (via statute) from the ability to test the waters before the accommodation was expanded to all issuers (via rule) in registered offerings. Regulation A currently provides issuers with a modified ability to test the waters, permitting Regulation A issuers to solicit interest in a potential offering from the general public provided certain legend and other requirements are met. However, other exemptions do not permit issuers to test the waters. Pursuant to the proposed rules, an issuer could solicit indications of interest in an exempt offer without first settling on which exemption will be used. This would allow an issuer who has tested the waters to still engage in a number of different exempt offerings rather than circumscribing the options available. The new rules would also permit generic solicitations of interest — as opposed to solicitations to only QIBs or IAIs — if the issuer wanted to pursue an offering under Regulation A or Regulation Crowdfunding (i.e., a registration exemption that permits general solicitation). Because general solicitations are still prohibited for many exempt offerings, engaging in general solicitation would still preclude an issuer’s qualifying for an exempt offering that does not permit it.

Another newly permitted communication would include “demo day” participation, which the SEC would not consider a general solicitation under the proposal. Typically on demo days, a group of issuers assemble and pitch their presentation to an audience of incubator, accelerator, angel or other investors. Provided parties’ adherence to certain conditions (including that issuers do not reference any specific securities offerings that are being contemplated and event sponsors do not give investment recommendations, charge fees or receive compensation), issuers can participate in “demo day” under the proposed rules without foreclosing the availability of a traditional Rule 506(b) offering.

Improving Issuer Utilization of and the Investor Base for Certain Exempt Offerings

The SEC noted that registered offerings account for $1.2 trillion of new capital, compared to an estimated $2.7 trillion raised in the private market. Despite the robust private market, certain exemptions are comparatively underused. In particular, offerings pursuant to Regulation A, Regulation Crowdfunding and Rule 504 of Regulation D combined comprise a negligible portion of the exempt offering market by value.

Restrictions on offering size, investor qualification criteria and total investment limitations in these exempted offerings may explain their rare use. In response, the SEC has proposed raising the offering limits in Tier 2 Regulation A offerings from $50 million to $75 million, in Rule 504 of Regulation D offerings from $5 million to $10 million and in Regulation Crowdfunding offerings from $1.07 million to $5 million. The SEC has also proposed easing certain investor and investment restrictions applicable to Regulation Crowdfunding offerings by (i) removing investment limits from accredited investors and (ii) revising the calculation method for investment limits applicable to nonaccredited investors, enabling them to rely on the greater of their annual income or net worth when calculating their limits. In addition to expanding investment thresholds for these exempted offerings, the SEC proposed amendments to make Regulation Crowdfunding offerings more attractive to issuers and investors by permitting investors to aggregate their investments via certain special purpose vehicles. This proposal aims to reduce the administrative complexities associated with managing a large and diffuse investor base, while ensuring investors maintain the same degree of economic exposure, voting power and access to information as if the investor had invested in the issuer directly.

Additional Amendments

The proposal also seeks to harmonize and clarify additional rules applicable to select offerings, including by:

- aligning the bad actor disqualification provisions that apply in Regulation D, Regulation A and Regulation Crowdfunding;

- permitting a purported accredited investor to verify its accredited investor status by providing a written representation to the issuer, so long as the issuer is not aware of anything to the contrary; and

- harmonizing aspects of the offering process across exemptions (for example, by making the information that companies must provide to nonaccredited investors under Rule 506(b) equivalent to what they provide to investors in Regulation A offerings).

Conclusion

The latest SEC proposals should increase issuers’ ability to raise additional private capital from a more diverse group of investors.by providing a more rational framework for offerings that are exempt from registration.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.