On March 12, 2020, the U.S. Securities and Exchange Commission (SEC) adopted amendments to the accelerated filer and large accelerated filer definitions under Rule 12b-2 of the Exchange Act to reduce burdens and compliance costs for certain smaller registrants. Under the new rules, certain low-revenue registrants no longer are required to have their assessment of the effectiveness of internal control over financial reporting (ICFR) attested to, and reported on, by their independent auditors.

The final amendments, which are summarized below, become effective on April 27, 2020, and apply to any annual report filing due on or after the effective date.

Background

In 2018, the SEC revised the definition of a “smaller reporting company” to expand the number of registrants that can utilize the scaled-down disclosure requirements that are available to smaller reporting companies. Following these amendments, however, some registrants were categorized as both smaller reporting companies and accelerated or large accelerated filers, resulting in a requirement for these registrants to obtain an auditor attestation of their ICFR. The final rules are intended to appropriately narrow the types of registrants that are included in the accelerated and large accelerated filer definitions.

Amendments to Exclude Low-Revenue Smaller Reporting Companies

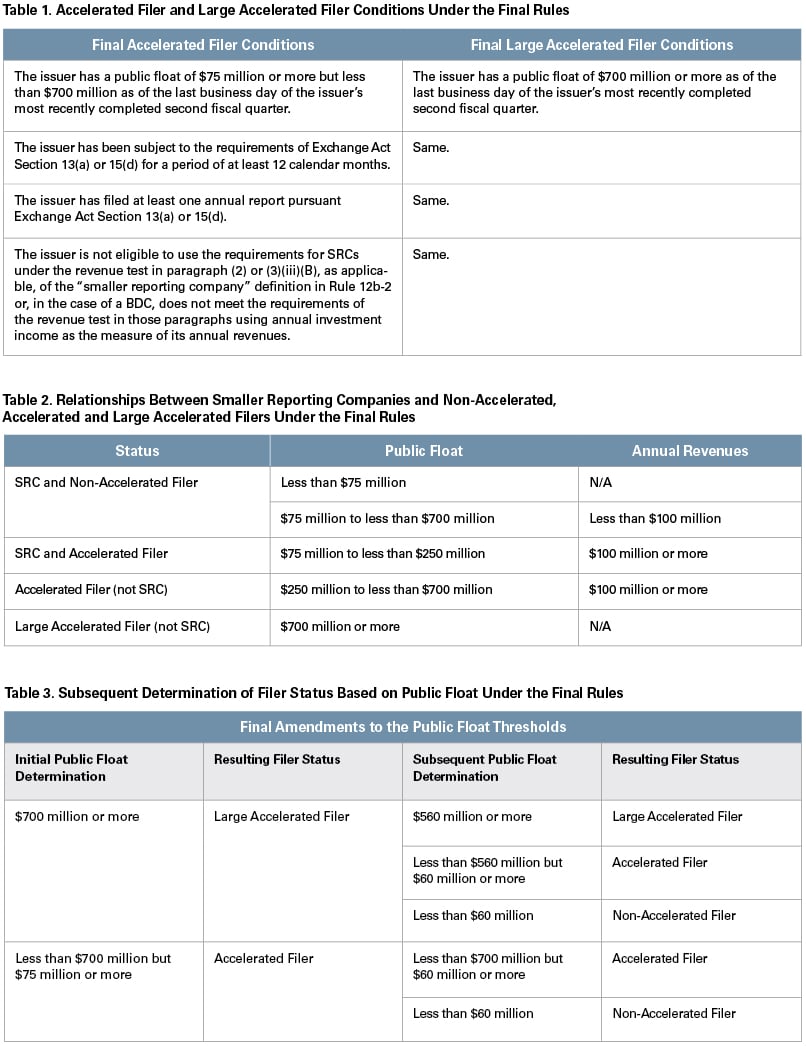

The new rules revise the accelerated and large accelerated filer definitions to exclude from those definitions registrants that are eligible to be treated as a smaller reporting company (SRC) and that had annual revenues of less than $100 million in the most recent fiscal year for which audited financial statements are available. The amendments provide that business development companies (BDCs) can also qualify for this low-revenue exclusion using their annual investment income as a measure of annual revenue, although BDCs would continue to be ineligible to be smaller reporting companies. See Table 1, “Accelerated Filer and Large Accelerated Filer Conditions Under the Final Rules” and Table 2, “Relationships Between Smaller Reporting Companies and Non-Accelerated, Accelerated, and Large Accelerated Filers Under the Final Amendments.”

The amendments further provide that a foreign private issuer (FPI) is excluded from the accelerated and large accelerated filer definitions if it qualifies, and elects to be treated, as a smaller reporting company based on the low-revenue test described immediately above. As was the case before the amendments, however, an FPI that does not elect to be treated as a smaller reporting company (e.g., it does not use the forms and rules designated for domestic issuers and does not provide financial statements in accordance with U.S. Generally Accepted Accounting Principles) will not be excluded from the accelerated and large accelerated filer definitions based on the low-revenue test.

While registrants that are eligible to be treated as a smaller reporting company based on the low-revenue test are not subject to the requirement to obtain an auditor attestation of their ICFR, they generally remain subject to the requirements of Section 404(a) of the Sarbanes-Oxley Act and related rules that require (except in the case of newly public companies) a management report on ICFR in annual reports filed with the SEC. Further, the final amendments do not change an auditor’s role in the financial statement audit.

Check Box on Annual Report Cover Pages

The amendments add a check box to the cover pages of annual reports on Forms 10-K, 20-F and 40-F to indicate whether an ICFR auditor attestation is included in the filing.

Amendments to Transition Provisions

The new rules increase the transition thresholds for accelerated and large accelerated filers to become non-accelerated filers from $50 million to $60 million and increase the threshold for exiting large accelerated filer status from $500 million to $560 million. See Table 3, “Subsequent Determination of Filer Status Based on Public Float Under the Final Amendments.” The SEC increased the public float transition thresholds so that they are 80% of the initial thresholds, which is consistent with the percentage used in the transition thresholds for smaller reporting company eligibility. The amendments also add a revenue test to the transition thresholds for exiting both accelerated and large accelerated filer status.

Associate Kashira Patterson contributed to this article.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.