On April 6, 2020, the New York Stock Exchange (NYSE) filed an immediately effective rule change with the Securities and Exchange Commission (SEC) that waives the application of certain shareholder approval requirements through June 30, 2020.1 This alert briefly summarizes the changes. For a more comprehensive overview of the shareholder approval rules applicable to NYSE- and Nasdaq-listed companies, please see the NYSE and Nasdaq Shareholder Approval Rules chart at the end of this alert.

See all our COVID-19 publications and webinars.

Shareholder Approval Rules

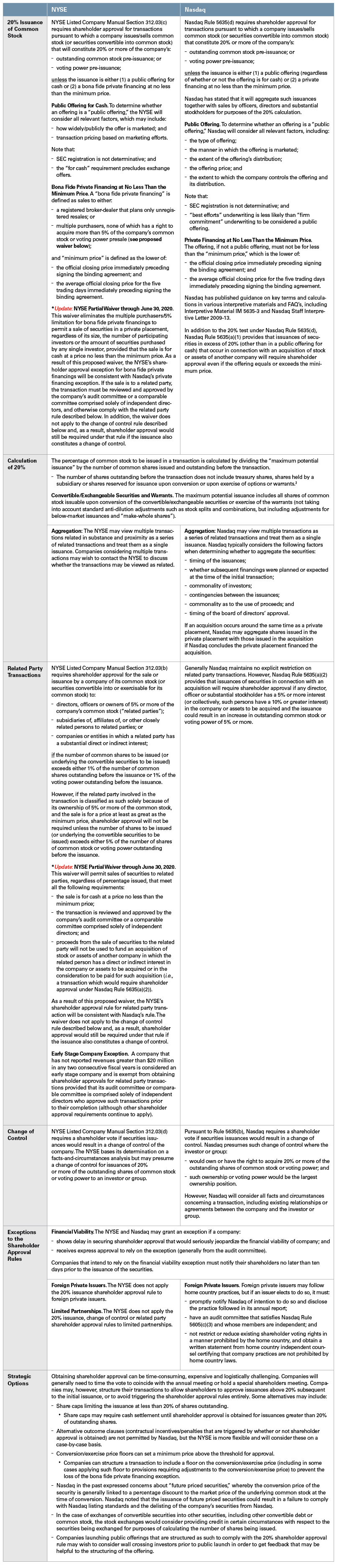

The NYSE Listed Company Manual requires listed companies to obtain majority shareholder approval of certain transactions, especially those that may dilute existing shareholders’ voting power or the value of their equity, those that involve transactions with company insiders, or those that would change significantly the structure and ownership of a company. As a result of the NYSE actions, two shareholder approval rules, known colloquially as the “20% Rule” and the “Related Party Transactions Rule” are subject to partial, temporary waiver.

20% Rule

Pursuant to the 20% Rule, a NYSE-listed company must obtain shareholder approval for issuances of more than 20% of the company’s outstanding common stock or voting power. The 20% Rule is subject to exceptions, including bona fide private placements to multiple purchasers, none of whom are acquiring more than 5% of the company’s common stock or voting power, provided that the offer meets certain minimum price requirements — namely that the price exceeds the lesser of the official common stock closing price immediately prior to signing the agreement or the average official closing price for the five trading days immediately preceding the signing of the binding agreement.

After observing that the COVID-19 pandemic has created a liquidity crisis for many companies, the NYSE noted that companies in distress often may obtain funding most easily in private transactions with a few key investors, including insiders who are already shareholders of the company. The NYSE further noted that in the 2008-2009 financial crisis, many NYSE-listed companies in need of equity financing were limited by the shareholder approval rules in the size and structure of their capital raising.

The temporary partial waiver of Section 312.03(c) eliminates the 5% ownership/voting power threshold, permitting private placements of securities, regardless of their size, the number of participating investors or the amount of securities purchased by any single investor, provided that minimum pricing requirements are met. Additional requirements apply if the sale is to a related party (as described below). Such transactions must be reviewed and approved by the company's audit committee or a comparable committee comprised solely of independent directors, and must otherwise comply with the related party transactions rule, described below. So long as such requirements are met, the company would not be required to make a public announcement of its reliance on the waiver, inform existing shareholders or take other steps to benefit from this relief of obtaining shareholder approval. The waiver does not apply to transactions that require shareholder approval due to a change of control (described in the following chart). As a result of this proposed waiver, the NYSE’s shareholder approval exception for bona fide private financings temporarily will be consistent with Nasdaq’s private financing exception (described in the following chart).

Related Party Transactions Rule

The shareholder approval rules view transactions with company insiders — including directors, officers and holders of 5% or more of the company’s common stock — with heightened scrutiny. Shareholder approval is required if the number of common shares to be issued to any related party exceeds 1% of either the pre-issuance outstanding common stock or voting power. For related parties who meet the definition solely by virtue of their common stock holdings or voting power and no other insider status, shareholder approval is required for issuances that exceed 5%, provided certain minimum pricing conditions are met.

The waiver significantly broadens the current exceptions and permits sales of securities to related parties, regardless of percentages issued, provided that:

- the sale is for cash at a price no less than the minimum price;

- the transaction is reviewed and approved by the company’s audit committee or a comparable committee comprised solely of independent directors; and

- proceeds from the sale of securities to the related party will not be used to fund an acquisition of stock or assets of another company in which the related person has a direct or indirect interest or assets to be acquired or in the consideration to be paid for such acquisition (i.e., a transaction which would require shareholder approval under Nasdaq Marketplace Rule 5635(a)(2)).

As a result of the waiver of Section 312.03(b), the NYSE’s shareholder approval rule for related party transactions temporarily will be consistent with Nasdaq’s rule. The waiver does not apply to transactions that implicate a change of control and, as a result, shareholder approval would still be required under that rule if the issuance also constitutes a change of control (described in the following chart).

Conclusion

In the notice announcing the changes, NYSE staff observed that “[e]xisting large investors are often the only willing providers of much-needed capital to companies undergoing difficulties and the [NYSE] believes that it is appropriate to increase companies’ flexibility to access this source of capital for a limited period.” The temporary shareholder approval waivers are a welcome change for companies experiencing a current liquidity crisis, and should remove impediments to raising capital in private offerings, especially those involving significant stakeholders or those who are willing to become significant stakeholders in the company. Provided no change of control is implicated, such investors may increase their ownership positions without the company needing to pursue a costly and time-consuming approval by a majority of shareholders. The changes are consistent with other recent rulemaking initiatives by the NYSE, which also recently proposed relaxing its continued listing requirements by suspending the application of its $50 million market capitalization and $1.00 price requirements.

_________

1 The changes came in the form of an immediately effective proposed rule. A proposed rule change does not ordinarily become operative until at least 30 days after filing. However, the NYSE requested an immediate effectiveness date, and the SEC, finding that waiving the 30-day period was consistent with the protection of investors and the public interest, waived the delay and designated the proposal operative upon filing, pursuant to Securities Exchange Act Rule 19b-4(f)(6)(iii).

2 For a company with dual class stock, the number of common shares that may be issued in a transaction is calculated by dividing the “maximum potential issuance” by the total number of common shares issued and outstanding in all classes (not just the specific class of shares being issued) before the transaction.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.