The Securities and Exchange Commission (SEC) recently adopted final rules that significantly revise the exempt offering framework, expanding access to capital markets for both issuers and investors. Key changes include the establishment of bright-line integration safe harbors, which clarify when the SEC will regard distinct offers as integrated for the purpose of determining compliance with registration exemptions and other applicable securities regulations. The amendments also expand the scope of permissible offering communications, raise the maximum offering size of certain exempted offerings, and generally simplify and harmonize the exempt offering framework. These changes are consistent with the SEC’s recent initiatives to reduce regulatory burdens and expand market access while ensuring sufficient investor protections. The final amendments are substantially similar to those proposed in March 2020.

The amendments, which were adopted earlier this month, will go into effect 60 days after publication in the Federal Register, with the exception of the extension of temporary Regulation Crowdfunding regulations, which will go into effect upon publication in the Federal Register.

Updating the ‘Integration’ Framework

The concept of “integration” in the context of a securities offering refers to the circumstances in which the SEC will determine that two or more nominally separate offerings are related and combine them for the purposes of assessing whether the issuer complied with applicable registration and other regulatory requirements. The integration doctrine is designed to discourage issuers from artificially separating a single securities offering that would otherwise require registration into two or more nominally distinct offerings to avoid the registration requirements. If the SEC determines that multiple offerings should be integrated, especially if the offerings were conducted pursuant to different exemptions, the combined transaction typically will fail to satisfy the requirements of any exemption.

Historically, the analysis of whether offerings would be integrated has lacked bright-line certainty, as it has utilized a somewhat murky five-factor test. More recently, for certain exemptions only, the SEC began moving away from the five-factor test to a facts-and-circumstances assessment1 and also created a limited number of offering-specific safe harbors.2 The absence of a bright-line rule or single standard, combined with the complexity of the exempt offering framework, has resulted in a lack of clarity about how to structure offerings, how the SEC will evaluate multiple offerings and when exemptions from registration will be available.

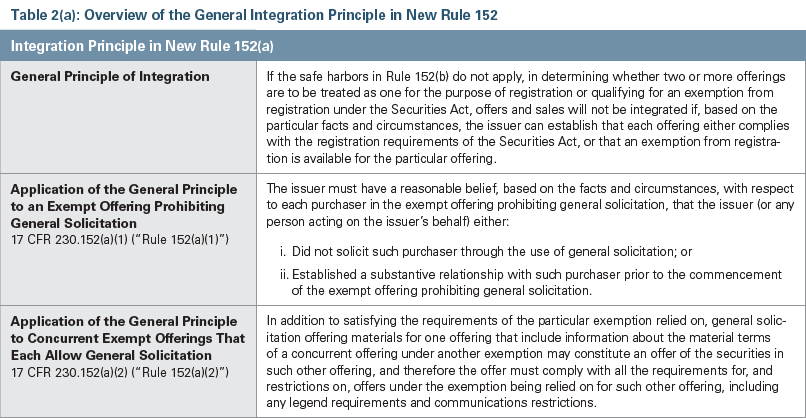

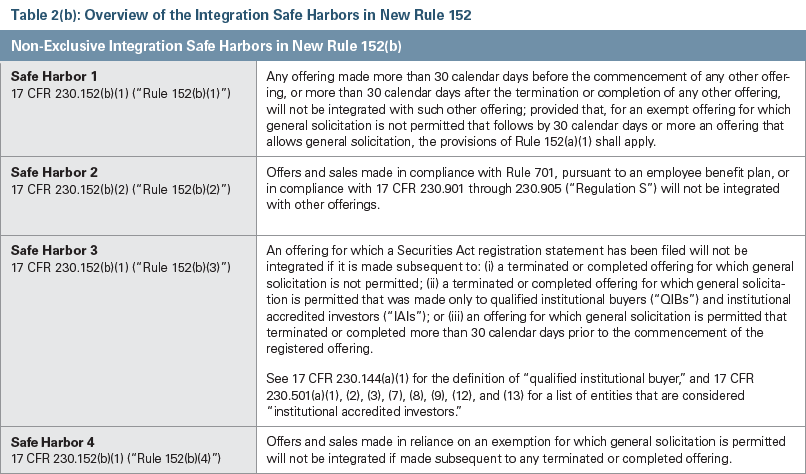

New Rule 152 moves away from the five-factor test, building upon the more recent facts-and-circumstances approach while also establishing four nonexclusive safe harbors from integration. Where an issuer can establish application of a safe harbor, the offerings will not be integrated. If a safe harbor does not apply, issuers should apply the general principle of integration to assess the particular facts and circumstances of the offering.

The following tables, excerpted from the adopting release, provide an overview of the general integration principles, followed by the four safe harbors.

As the safe harbors refer to offer termination and commencement of offerings, new Rule 152 includes a number of nonexclusive factors that may be relevant to the termination of an offering. Many of these factors are offering-specific, but they generally include, for private offerings, the date the issuer enters into a binding commitment to sell the securities, or alternatively, when an issuer ceased making attempts to sell the securities. For registered offerings, relevant factors include: the date of withdrawal of the registration statement, when a prospectus supplement or amendment to the registration statement indicating the offer has been terminated is filed, the date of entry of an order by the SEC that the offer has been abandoned, the third anniversary after an issuer has filed a shelf registration statement, the date the issuer is precluded from selling securities pursuant to the registration statement, or any other date where the offering terminates by its terms or any other factors that indicate the issuer has abandoned or terminated the offer.

Rule 152 also includes factors to consider in determining when an offering has commenced. The nonexclusive factors that might indicate commencement of an offering include: the first date an offer is made (whether generic, or in reliance on an exemption from registration), the date upon which an issuer files a shelf-registration statement for an offering that will commence upon effectiveness of such statement, and the date of filing of a press release or proxy supplement, or other public efforts to buy and sell in the case of a delayed offering.

Reducing Limitations on Communications During the Offering Process

Testing the Waters

The SEC also expanded the scope of permissible communications in private offerings. In testing-the-water communications, an issuer may engage in oral or written communications with eligible investors to gauge potential interest in an offering before or after filing a registration statement for that offering. Regulation A currently provides issuers with a modified ability to test the waters, permitting Regulation A issuers to solicit interest in a potential offering from the general public provided certain legending and other requirements are met. However, other exemptions do not permit issuers to test the waters.

Pursuant to new Rule 241, issuers may solicit indications of interest in an exempt offering without first settling on which exemption will be used, but they must elect an exemption before investor commitments are solicited or accepted. This will allow an issuer who has tested the waters to still engage in a number of different exempt offerings rather than limit the options available. The new rules will also permit generic solicitations of interest — as opposed to solicitations to only “qualified institutional buyers” or “institutional accredited investors” — if the issuer wanted to pursue an offering under Regulation A or Regulation Crowdfunding (i.e., a registration exemption that permits general solicitation). However, because general solicitations are still prohibited for many exempt offerings, an issuer who engages in general solicitation would be precluded from qualifying for an exemption that does not permit it.

Note that in connection with the testing-the-waters communications, issuers must adhere to legending requirements and, if securities are sold under Rule 506(b) within 30 days of the testing-the-waters communications to any purchaser who is not an accredited investor, the issuer must provide purchasers with any written testing-the-waters materials used. If a Regulation A or Regulation Crowdfunding offer is commenced within 30 days of the testing-the-waters communication, the written materials used must be made publicly available as an exhibit to the offering materials filed with the SEC.

Demo Day Participation

Under new Rule 148, “demo day” participation will not be considered a general solicitation. Typically on demo days, a group of issuers assemble and pitch their presentations to an audience of incubator, accelerator, angel or other investors. Under the new rule, issuers may participate in a “demo day” without foreclosing the availability of a traditional Rule 506(b) offering, provided that participants adhere to certain conditions, including that more than one issuer must attend the event and that event sponsors do not give investment recommendations, charge fees or receive compensation. In addition, issuers are also limited in what they may communicate and may state only:

- that the issuer is in the process of offering or planning to offer securities;

- the type and amount of securities being offered;

- the intended use of the offering proceeds; and

- the unsubscribed amount of the offering.

Further, if the event is online, participation should be limited to:

- individuals who are associated with the sponsor organization;

- individuals the sponsor reasonably believes are accredited investors; and

- individuals invited by the sponsor based on industry or investment-related experience reasonably selected by the sponsor in good faith and disclosed in public communications about the event.

Improving Issuer Utilization of and the Investor Base for Certain Exempt Offerings

The SEC noted in its proposing release that registered offerings accounted for $1.2 trillion of new capital, compared to an estimated $2.7 trillion raised in the private market in 2019. Despite the robust private market, certain exemptions are comparatively underused. In particular, offerings pursuant to Regulation A, Regulation Crowdfunding and Rule 504 of Regulation D combined comprise a negligible portion of the exempt offering market by value.

Restrictions on offering size, investor qualification criteria and total investment limitations in these exempted offerings may explain their rare use. In response, the SEC has raised the offering limits:

- in Tier 2 Regulation A offerings: from $50 million to $75 million,

- in Rule 504 of Regulation D offerings: from $5 million to $10 million, and

- in Regulation Crowdfunding offerings: from $1.07 million to $5 million.

The amended rules also ease certain investor and investment restrictions applicable to Regulation Crowdfunding offerings by (i) removing investment limits from accredited investors and (ii) revising the calculation method for investment limits applicable to nonaccredited investors, enabling them to rely on the greater of their annual income or net worth when calculating their limits. In addition to expanding investment thresholds for these exempted offerings, the SEC has attempted to make Regulation Crowdfunding offerings more attractive to issuers and investors by permitting investors to aggregate their investments via certain special purpose vehicles. This amendment aims to reduce the administrative complexities associated with managing a large and diffuse investor base while ensuring investors maintain the same degree of economic exposure, voting power and access to information as if the investor had invested in the issuer directly.

Additional Amendments

The amendments also harmonize and clarify additional rules applicable to select offerings, including by:

- aligning the bad actor disqualification provisions that apply in Regulation D, Regulation A and Regulation Crowdfunding;

- permitting a purported accredited investor to verify its accredited investor status by providing a written representation to the issuer, so long as the issuer is not aware of anything to the contrary; and

- harmonizing aspects of the offering process across exemptions (for example, by making the information that companies must provide to nonaccredited investors under Rule 506(b) equivalent to what they provide to investors in Regulation A offerings).

In addition, the amendments revised the provisions in Items 601(b)(2) and 601(b)(10) of Regulation S-K to update the standard for redacting confidential information in line with a recent U.S. Supreme Court interpretation of the Freedom of Information Act. The amendments remove the “competitive harm” standard and permit information to be redacted if it is the type that the issuer both customarily and actually treats as private or confidential, and is not material.

Conclusion

The latest SEC amendments should increase issuers’ ability to raise additional private capital from a more diverse group of investors by providing a more rational framework for offerings that are exempt from registration.

_______________

1 A facts-and-circumstances assessment has applied to Regulation A and Regulation Crowdfunding since 2015 and to Rule 147 and Rule 147A rulemaking since 2016, in the context of concurrent exempt offerings.

2 For example, as paragraphs (b) and (c) establish for Section 4(a)(2) of the Securities Act, or the safe harbor Rule 147 provides under Section 3(a)(11) of the Securities Act.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.