On July 17, 2018, the House of Representatives passed the JOBS and Investor Confidence Act (JOBS Act 3.0), a package of reforms consisting of 32 pieces of legislation principally designed to spur entrepreneurship by reinvigorating business startups and initial public offerings (IPOs). The legislation aims to expand upon the 2012 Jumpstart our Business Startups Act (JOBS Act) and the Fixing America’s Surface Transportation Act (FAST Act).

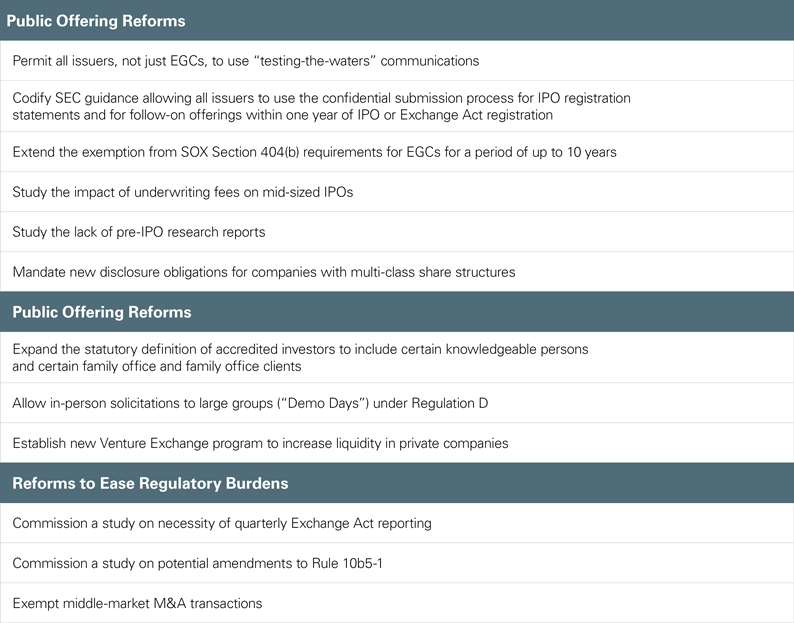

Characterized by the House Financial Services Committee as the “third and largest installment” of JOBS Act legislation, the reforms in the bill further streamline the regulation of IPOs, extend certain disclosure exemptions for emerging growth companies (EGCs) and expand the definition of accredited investors. Of particular note, the bill would allow all issuers, not just EGCs, to use “testing-the-waters” communications in connection with securities offerings.

The legislation must now be returned to the Senate, where it may be considered as approved by the House, amended and returned to the House, reconciled with the House through a conference committee or set aside with no further action. While the JOBS Act 3.0 passed the House with strong bipartisan support, the bill may face challenges, at least with respect to timing, as it heads to the Senate as members of both parties look ahead to midterm elections. The following is a summary of the key capital markets reforms contained in the bill:

Background

The original JOBS Act, enacted in 2012, sought to ease regulatory burdens on smaller companies and facilitate public and private capital formation. Most prominently, the JOBS Act created a new class of issuers, EGCs, with less than $1 billion (subsequently increased to $1.07 billion) in annual revenues and implemented changes to the IPO process to establish an “on-ramp” with scaled-down disclosure requirements for EGCs. The FAST Act, enacted in 2015, contained several additional provisions that reflected further congressional efforts to increase IPOs by EGCs, reduce the burdens on smaller companies seeking to conduct registered offerings and provide trading liquidity for securities of private companies. The FAST Act was initially referred to as the JOBS Act 2.0.

The new JOBS Act 3.0 continues the trend of congressional legislation aimed at stimulating the domestic IPO market, easing private capital formation and generally streamlining regulation.

Public Offering Reforms

Testing the Waters and Confidential Submissions (Title IX)

The JOBS Act significantly eased long-standing restrictions on “gun-jumping” under Section 5 of the Securities Act of 1933 (Securities Act) by permitting EGCs, or persons authorized to act on an EGC’s behalf, to make oral and written offers to qualified institutional buyers and institutional accredited investors (“testing-the-waters” communications) before or after the filing of a registration statement to gauge investors’ interest in the offering. Title IX, Section 901 of the JOBS Act 3.0 expands these accommodations to permit all issuers, not just EGCs, to engage in testing-the-waters communications. The JOBS Act also introduced a confidential submission process for EGCs to furnish draft IPO registration statements to the SEC for review. Title IX, Section 901 of the JOBS Act 3.0 amends the Securities Act to permit all issuers contemplating (i) an IPO or (ii) a follow-on offering within one year of an IPO or registration under the Securities Exchange Act of 1934 (Exchange Act) — e.g., a spin-off — to take advantage of the confidential review process, subject to the requirement that the registration statement and all nonpublic draft submissions be publicly filed with the SEC no later than 15 days before the date on which the issuer conducts a roadshow, in the case of an IPO, and prior to effectiveness at a date and time determined by the SEC, in the case of a follow-on offering. This essentially codifies staff guidance from August 2017.1

Exemption From Auditor Attestation Provision of SOX for Certain EGCs (Title V)

Under Section 404 of the Sarbanes-Oxley Act of 2002 (SOX) and related SEC rules, each annual report of a public company (other than the initial annual report for a newly reporting public company) must contain a report on internal control over financial reporting that, among other things, includes management’s opinion on the effectiveness of the company’s internal control over financial reporting. The JOBS Act exempted EGCs from the separate requirement that an issuers’ independent auditor include an attestation report on the effectiveness of the company’s internal control over financial reporting for the first five years after going public. The Section 404 auditor attestation requirement has long been considered a disincentive to being a public company. Title V, Section 501 of the JOBS Act 3.0 would allow issuers with average annual gross revenues of less than $50 million to continue to take advantage of the EGC exemption from the auditor attestation requirement until the earliest of (i) the last day of the fiscal year of the issuer following the 10th anniversary of the first sale of registered common equity securities, (ii) the last day of the fiscal year of the issuer during which the average annual gross revenues of the issuer exceeds $50 million, or (iii) when the issuer becomes a large accelerated filer (i.e., generally a company with a public float of at least $700 million that has been publicly reporting for at least one year).

‘Middle Market’ Underwriting Cost Study (Title XXXI)

As noted above, the JOBS Act sought to counter a perceived declining IPO market. Some commentators, including SEC Commissioner Robert Jackson, have pointed to the high level of IPO costs, particularly underwriting fees, as a major factor for this decline. Title XXXI, Section 3101 of the JOBS Act 3.0 would require the SEC to study the direct and indirect costs of an IPO, including underwriting fees, compliance with federal and state securities laws, and other related costs the SEC deems appropriate. The study and the requisite recommendations therein would be used to consider reforms to the IPO market, particularly for small and medium-sized companies.

Pre-IPO Research Study (Title XXIV)

By excluding research reports on EGC IPOs from the definition of “offer” in Section 2(a)(3) of the Securities Act, the JOBS Act sought to encourage (and permit) investment banks to publish pre-IPO research on such offerings. Despite this, commentators have observed an apparent dearth of pre-IPO research. Title XXIV, Section 2401 of the JOBS Act 3.0 aims to address this by requiring the SEC to carry out a study to evaluate issues affecting the provision of and reliance upon investment research into small issuers and pre-IPO companies, including EGCs and other small issuers. The bill requires that the study consider factors related to demand for research; the availability of research; conflicts of interest relating to the production and distribution of research; the costs of research; the impacts of different payment mechanisms for investment research into small issuers; unique challenges faced by minority-owned, women-owned, and veteran-owned small issuers in obtaining research coverage; and the impact on the availability of research coverage for small issuers due to investment adviser and broker-dealer concentration and consolidation.

Increased Disclosure for Companies With Multi-Class Shares (Title XXIX)

Multi-class capital structures, wherein companies have two or more classes of authorized common stock with different amounts of voting power, allow company insiders to retain control of the company despite being public. These structures have been increasingly prevalent in recent IPOs, drawing attention from both regulators and investors. Title XXIX, Section 2901 of the JOBS Act 3.0 would require companies with multi-class capital structures to make certain disclosures in proxy and consent solicitation materials for annual meetings (or any other filings the SEC deems appropriate) about directors, director nominees, named executive officers and persons who hold 5 percent or more of the combined voting power of all classes of stock entitled to vote in director elections. The disclosure would be aimed at the aggregate influence of these persons — specifically, the amount of equity interest directly or indirectly owned by such persons, expressed as a percentage of the total value of the outstanding equity securities of the issuer and the amount of voting power held by such person, expressed as a percentage of the total combined voting power of all classes of the securities.

Private Offering Reforms

Accredited Investor Definition Amendments (Title IV and Title X)

The JOBS Act 3.0 proposes reforms to facilitate private offerings in addition to public offerings. Title IV, Section 401 of the JOBS Act 3.0 would increase the pool of potential investors for private offerings by expanding the statutory “accredited investor” definition to account for educational or professional expertise, as verified by certain regulatory authorities. Specifically, the amended definition would include natural persons, regardless of their financial status under the net worth/net income tests, who hold certain securities-related licenses as well as natural persons whom the SEC determines, by regulation, to have qualifying education or job experience related to a particular investment (and whose education and job experience is verified by FINRA or an equivalent self-regulatory organization). The bill also would direct the SEC to revise Regulation D to conform with the new statutory definitions.

In addition, Title X, Section 1001 of the JOBS Act 3.0 would deem family offices and family clients, as defined under the Investment Advisers Act of 1940, to satisfy the definition of accredited investor under Regulation D. This would only apply to a family office with assets under management in excess of $5 million, and a family office or a family client not formed for the specific purpose of acquiring the securities offered, and whose purchase is directed by a person who has such knowledge and experience in financial and business matters that such person is capable of evaluating the merits and risks of the prospective investment.

Angel Investor Sponsored ‘Demo Days’ (Title I)

Regulation D currently restricts startups from pitching investment opportunities to audience members who do not meet the financial requirements of an accredited investor. Title I, Sections 101 and 102 of the JOBS Act 3.0 would create a new statutory definition of “angel investor group” for groups of accredited investors, and directs the SEC to revise Regulation D to permit such groups to sponsor events, known as “Demo Days,” where issuers could pitch investors. This provision would also allow nonprofit organizations, colleges and universities or local governments to host such events. These types of events would no longer be classified as general solicitations as understood by Regulation D.

Venture Exchanges (Title XX)

Venture exchanges are securities markets specifically designed for trading smaller and startup company securities to increase liquidity for early stage investors in private startups. Title XX, Section 2001 of the JOBS Act 3.0 would amend the Exchange Act to allow for the registration of “venture exchanges” with the SEC to provide a venue tailored to the needs of small and emerging companies and offer qualifying companies a venue in which their securities could trade. The bill would permit trading of “venture securities,” a definition that would apply to early stage companies whose shares are exempt from Securities Act registration under Section 3(b), e.g., Regulation A+ securities, as well as listed companies whose shares are below a certain public float or average daily trade volume. Securities traded on a venture exchange would not be permitted to concurrently trade on a national securities exchange, and securities that trade only on a venture exchange would not be a “covered security” for purposes of Securities Act Section 18 and thus would not benefit from preemption from state “blue sky” registration statutes.

Reforms to Ease Regulatory Burdens

Form 10-Q Study (Title XXII)

Public companies that report under the Exchange Act are required to file current, quarterly and annual reports with the SEC. Title XXII, Section 2201 of the JOBS Act 3.0 would require the SEC to conduct an analysis on the costs and benefits of quarterly reporting on Form 10–Q, including the costs and benefits to investors and other market participants of the current requirements for reporting on Form 10-Q. The JOBS Act 3.0 includes a particular focus on the impact of quarterly reporting on EGCs, as well as the expected impact of the use of alternative formats for quarterly reporting by EGCs, such as through press releases. The bill directs the SEC to report to Congress with recommendations for decreasing costs, increasing transparency, and increasing efficiency of quarterly financial reporting by EGCs. The bill does not direct the SEC to evaluate annual reporting on Form 10-K or current reporting on Form 8-K.

Rule 10b5-1 Plan Study (Title XXVII)

Rule 10b5-1 plans recently have been subject to increasing controversy. Under Rule 10b5-1, issuers, directors, officers and other insiders and large shareholders who regularly possess material nonpublic information (MNPI) but who nonetheless wish to buy or sell stock may establish an affirmative defense to charges of illegal insider trading by adopting written plans to buy or sell at times when they are not in possession of MNPI. Title XXVII, Section 2701 of the JOBS Act 3.0 would require the SEC to study whether Rule 10b5-1 should be amended to limit the ability of issuers and insiders to adopt certain 10b5-1 plans only during issuer-adopted trading windows and limit the ability of issuers and insiders to adopt multiple, overlapping trading plans. In addition, after the completion of the study, the SEC is required to revise Rule 10b5-1 consistent with the results of the study. It should be noted that “best practices” for Rule 10b5-1 plans already include the aforementioned limitations.

Middle Market M&A (Title III)

Title III, Section 301 of the JOBS Act 3.0 would exempt certain brokers who facilitate the merger or acquisition of small businesses (M&A Brokers) from registration under the Exchange Act if the M&A Broker is engaged in the business of effecting securities transactions solely in connection with the transfer of ownership of an eligible privately held company. The bill defines an “eligible privately held company” as one that does not have any class of securities registered under Section 12 of the Exchange Act, and in the fiscal year ending immediately before the fiscal year in which the M&A broker is initially engaged, the company’s EBITDA is less than $25 million or the company’s gross revenues are less than $250 million. The bill would also disqualify “bad actors” from utilizing the simplified process and would not allow transactions involving shell companies.

_______________

1 Under existing staff guidance, an issuer conducting a follow-on offering within one year of an IPO or Exchange Act registration must publicly file its registration statement and all nonpublic draft submissions at least 48 hours prior to any requested effective time and date.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.